A few years ago, Buy Now, Pay Later (BNPL) felt like a novelty. Today, it’s everywhere: woven into checkout flows across fashion, travel, electronics, and more. New providers launch constantly, each promising merchants higher conversions and happier customers.

For merchants, that explosion of choice creates a new problem: which BNPL option should you prioritize?

Engineering resources are limited, and the wrong decision can mean missed customers, higher costs, and/or wasted time. Yet despite the noise, two names consistently rise to the top: Klarna and Afterpay.

- Klarna leads BNPL globally with around 38% merchant adoption and 53%+ global market share

- Afterpay (aka Clearpay) follows with over 348,000 global merchants and 22.5% market share

Below, we’ll detail the differences between Klarna and Afterpay for merchants, and what to consider as you make your choice.

We’ll also show a solution that removes the technical burden of integrating BNPL providers altogether, so you can easily add, remove, or combine them as your customers’ needs evolve.

Primer helps you to offer the perfect mix of payment methods for your customers, with no engineering resources after initial integration. Book a demo to learn more.

Klarna vs Afterpay: Seven key questions for merchants

Klarna and Afterpay are two of the leading BNPL methods globally. However, the choice of which one to integrate with first depends on your market, customer base, and vertical. Let’s break it down:

1. Where do you operate?

- Klarna: Global leader with strength in the US and Europe

Klarna has over 100 million active users across 26 countries. The US is its largest market, with 43 million users and a 26.2% market share. Klarna is also strong in Sweden, Norway, Germany, and the UK, where it has 11 million customers. - Afterpay: Market leader in Australia and New Zealand, strong challenger in the US

Afterpay has about 24 million active customers globally. In the US, where most of its merchants are based, it holds a 21.9% market share, compared to Klarna’s 26.2%. In Oceania, Afterpay dominates with 65.78% market share.

Merchant takeaway: Prioritize Klarna for Europe, Afterpay for Oceania. In the US, both are competitive, so you’ll need to consider other factors on this list before making a choice.

Read more about payment method preferences wherever your customers are:

2. What are the demographics of your customer base?

- Klarna: Average US user age is 36, with Baby Boomers (50+) as the fastest-growing demographic. 58% of Klarna customers are women.

- Afterpay: Skews younger. Usage among Gen Z and Millennials increased 22% YoY. Its CashApp partnership connects it to a platform where 37% of users are 18–24.

What this means for merchants:

Klarna resonates with older shoppers, while Afterpay is winning with Gen Z and Millennials in the US and Oceania.

3. What payment plans do your customers want?

Both Klarna and Afterpay offer interest-free installment plans. Both offer Pay in 4, where customers split purchases into four installments over six weeks. They also both charge fees for late payments, with the exact late fee depending on the order value and repayment plan type.

Klarna offers financing from 6-24 months (and up to 36 in some markets) with an APR of 21.9% at the time of writing. Also, it offers a Pay in 30 days option, giving customers the flexibility to pay the full balance a month after purchase.

Afterpay offers installment plans up to 24 months, with interest rates not publicly disclosed.

Merchant takeaway: Both offer flexibility with short-term installments for small online purchases and longer-term plans for high-ticket items with added interest.

4. How fast will you get paid, and what will it cost?

- Klarna payouts: Funds are disbursed on a set schedule, varying by contract. Typically $0.30 + 5.99% per sale.

- Afterpay payouts: Released within five business days. Fees are ~$0.30 + 4–6% per sale.

- Both Klarna and Afterpay have a US$15 chargeback fee.

Merchant takeaway: Fees are comparable, with Afterpay slightly lower on average. Payouts are similar, but Afterpay’s timeline is clearer.

5. How do they handle fraud and compliance?

BNPL is more vulnerable to fraud than traditional card payments due to low-friction signups and checkouts. Common risks include account takeover, synthetic identity fraud, and first-installment fraud.

In 2023, Consumer Reports reviewed eight BNPL providers. Klarna and Afterpay both ranked highly:

- Both are committed to real-time fraud monitoring.

- Afterpay scored higher on transparency.

- Klarna outperformed in certain technical categories.

- Klarna’s larger scale means more fraud exposure.

Merchant takeaway: Both perform well compared to peers, and the differences between the two are small.

6. Do you really need to choose?

For many merchants, the logical conclusion is to offer both and guide each customer to the most relevant option. Simple in theory, harder in practice.

Adding multiple BNPL providers to your stack in-house multiplies the complexity:

- Engineering lift: Every provider needs its own integration, along with custom checkout logic and fraud prevention flows.

- Payment routing: You’ll need to steer transactions intelligently to optimize performance and minimize BNPL’s higher costs compared to card payments.

- Operational overhead: Each provider has its own dashboards, reporting formats, and reconciliation rules. Without heavy manual effort, tasks such as comparing performance, tracking fraud, and managing disputes become messy and time-consuming.

This is why many merchants choose infrastructure platforms like Primer. With a single API, you can integrate Klarna, Afterpay, and any BNPL provider, without the engineering and operational burden.

How Primer enables you to integrate with multiple BNPL payment methods

For too long, payment teams have been forced into a trade-off. You could either:

- Integrate directly with each BNPL provider, taking on the endless engineering lift of APIs, ongoing maintenance, custom checkout logic, and fraud management.

- Rely on your PSP to connect you, only to face higher markups, slower payouts, and limited, pre-set routing and checkout options.

Neither path gave merchants true control. Payments became a bottleneck instead of a lever for growth.

Primer was built to change that.

Primer is the world’s first unified payments infrastructure, a platform designed to give payment teams the same agility as their product and engineering peers. Instead of juggling multiple integrations and dashboards, everything flows through a single control center.

Now, adding a new BNPL option doesn’t mean a new project plan. It just takes a few clicks. Routing isn’t locked behind a provider’s rules; it’s yours to design. Fraud tools aren’t bolted on, they’re orchestrated intelligently with no code required.

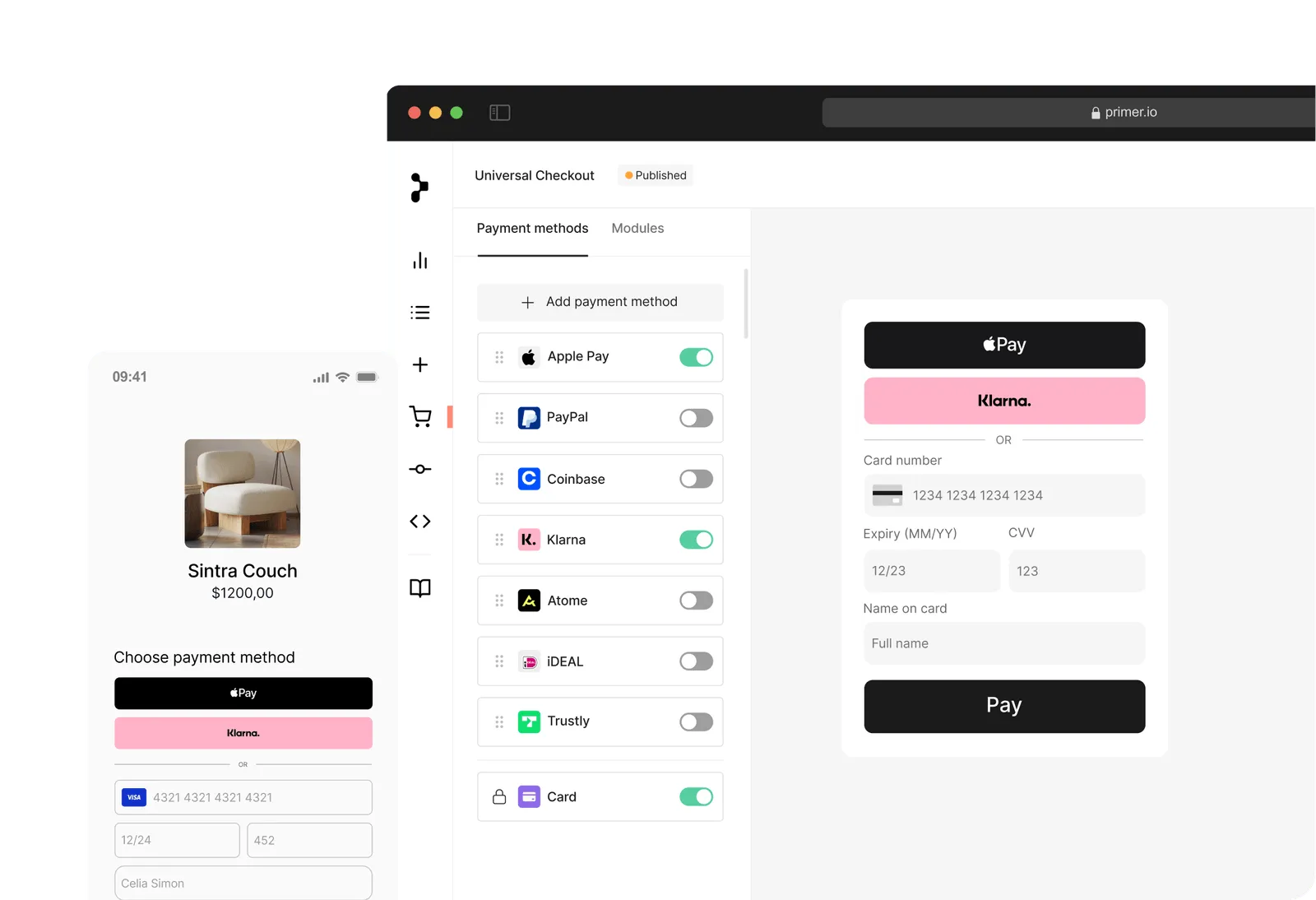

How to add both Klarna and Afterpay with Primer (as well as other payment methods)

With Primer, adding a new payment method is just a few clicks in your dashboard.

- Go to Connections in the Primer Dashboard, find the payment method you want.

- Follow the integration instructions on Primer Docs. The process will vary depending on whether you’re integrating directly or through a processor.

- Toggle on your payment methods in checkout, and set rules for how and when each payment option will appear to customers.

Primer also empowers you to activate other popular BNPL services, like:

- Atome

- Cetelem

- PayPal

- Alma

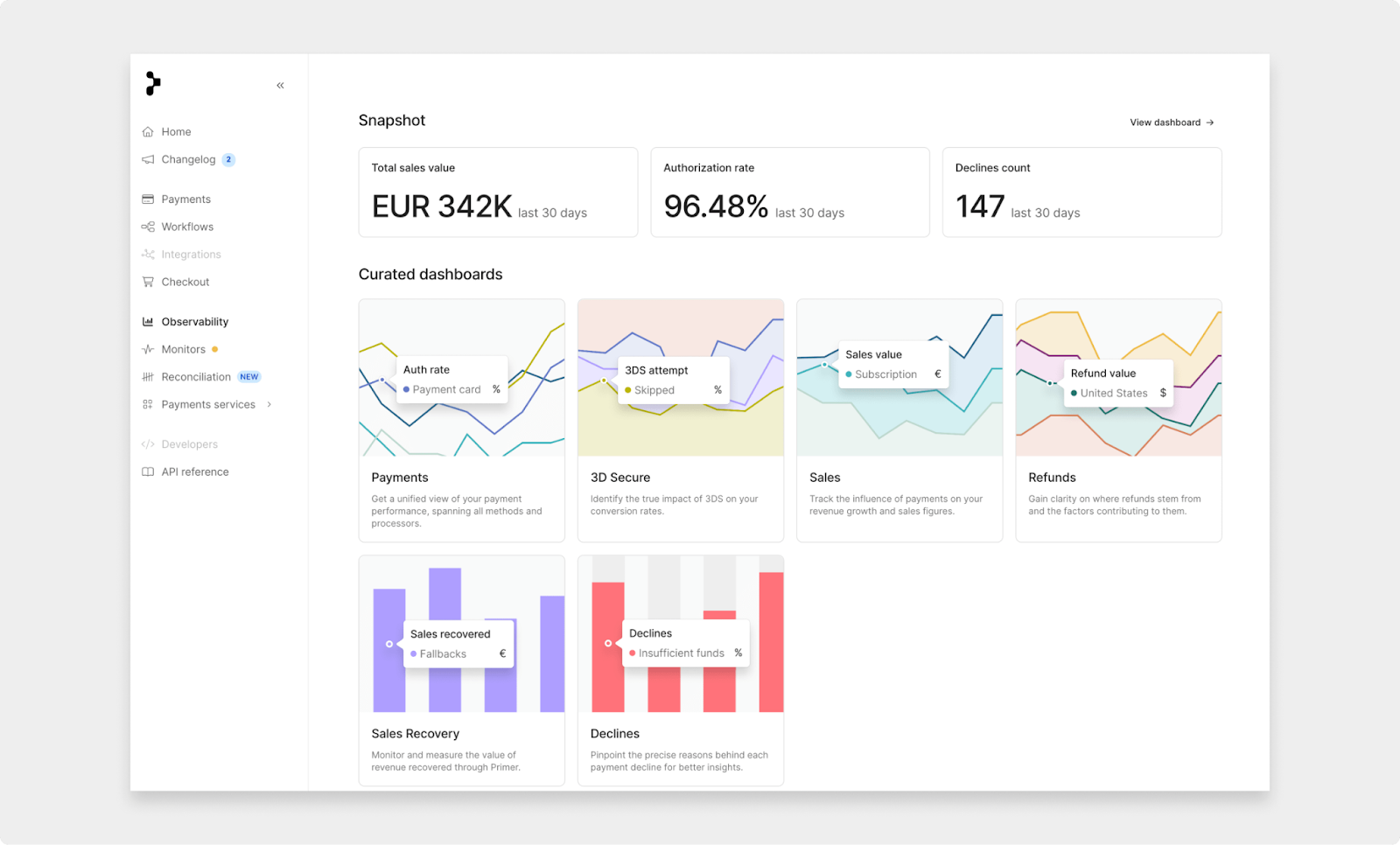

Use Observability Dashboard to experiment and analyze performance

Once you’ve set up Klarna, Afterpay, or any other method, Primer’s Observability Dashboard lets you see how they perform in real time.

The key is that you can test and adapt instantly. This puts the power back in the hands of payment teams: no more waiting on dev tickets, just the freedom to optimize and innovate at your own pace.

Read more: The art and science of A/B testing in payments

How DivBrands scaled global sales with BNPL

Klarna and other BNPL providers can clearly drive growth. But for merchants like DivBrands, which runs 17 brands across 19 international markets, adding and managing them at scale is no small feat.

Before partnering with Primer, DivBrands' payment team (just four people at the time) faced:

- Slow integrations: Each new connection (a BNPL method like Klarna or Atome) took a minimum of two weeks to set up.

- Operational drag: Each BNPL provider had its own dashboards, reconciliation rules, and fraud checks, making performance comparisons challenging.

- Checkout limitations: Scaling globally meant local languages, currencies, and even connectivity had to be accounted for, but customizing the checkout to deliver that experience was resource-intensive.

By moving to Primer, DivBrands was able to:

- Activate Klarna globally and Atome in Singapore within minutes rather than weeks.

- Experiment with multiple PSPs and fallback logic, improving authorization rates to around 90%.

- Roll out a lightweight, customizable checkout that matched their brand, worked across languages and currencies, and stayed fast even on poor internet connections.

Read the full interview here: In conversation with Gus Fune, Chief Technology Officer at Divbrands

Ready to add BNPL methods without developers or downtime?

Primer takes the engineering lift out of adding new payment methods, so you don’t have to choose between BNPL providers. Instead of weeks or months of coding, it takes just a few clicks to add all payment methods your customers want.

With Primer, you can activate Klarna, Afterpay, and other payment methods all in less time than it takes a shopper to check out. That means you can scale without leaving sales on the table, and meet your customers wherever they are.

Book a demo to see how easy it is to grow your payment stack with Primer.

Frequently asked questions (FAQs)

Do I need to choose between Klarna and Afterpay, or can I offer both?

No, you don’t have to choose. Many scaling merchants benefit from offering both Klarna and Afterpay, since they dominate in different regions and can appeal to different demographics. With Primer, you can activate both (and dozens of other payment methods)through a single integration, without extra engineering work.

Which BNPL provider is better for my business?

It depends on your industry and customer base. Klarna is especially strong in Europe and popular with a broader age range, while Afterpay dominates in Oceania, the U.S., and with younger shoppers. Offering both, along with a range of local BNPL methods, helps maximize conversions across a broader audience.

How much does it cost to accept Klarna or Afterpay?

Both BNPL providers charge a mix of fixed and percentage-based transaction fees, plus a $15 chargeback fee. Exact costs depend on your agreement. Primer can also help you route transactions intelligently, so you can process each transaction through the most affordable processor.

How long will it take to integrate Klarna or Afterpay and display it at checkout?

Traditionally, adding a BNPL method takes weeks of development. With Primer, you can easily activate Klarna, Afterpay, and many others to your checkout in just a few clicks –no code required. You can go live with a new payment method in minutes instead of weeks and months.

How can I track the performance of BNPL methods once they’re live?

Primer’s Observability Dashboard gives you a single view of all your payment data, and the ability to A/B test payment methods and processors. With Observability, you can easily compare authorization rates, conversions, and other metrics between Klarna and Afterpay, then refine your checkout flows to improve conversion rates globally.

.png)