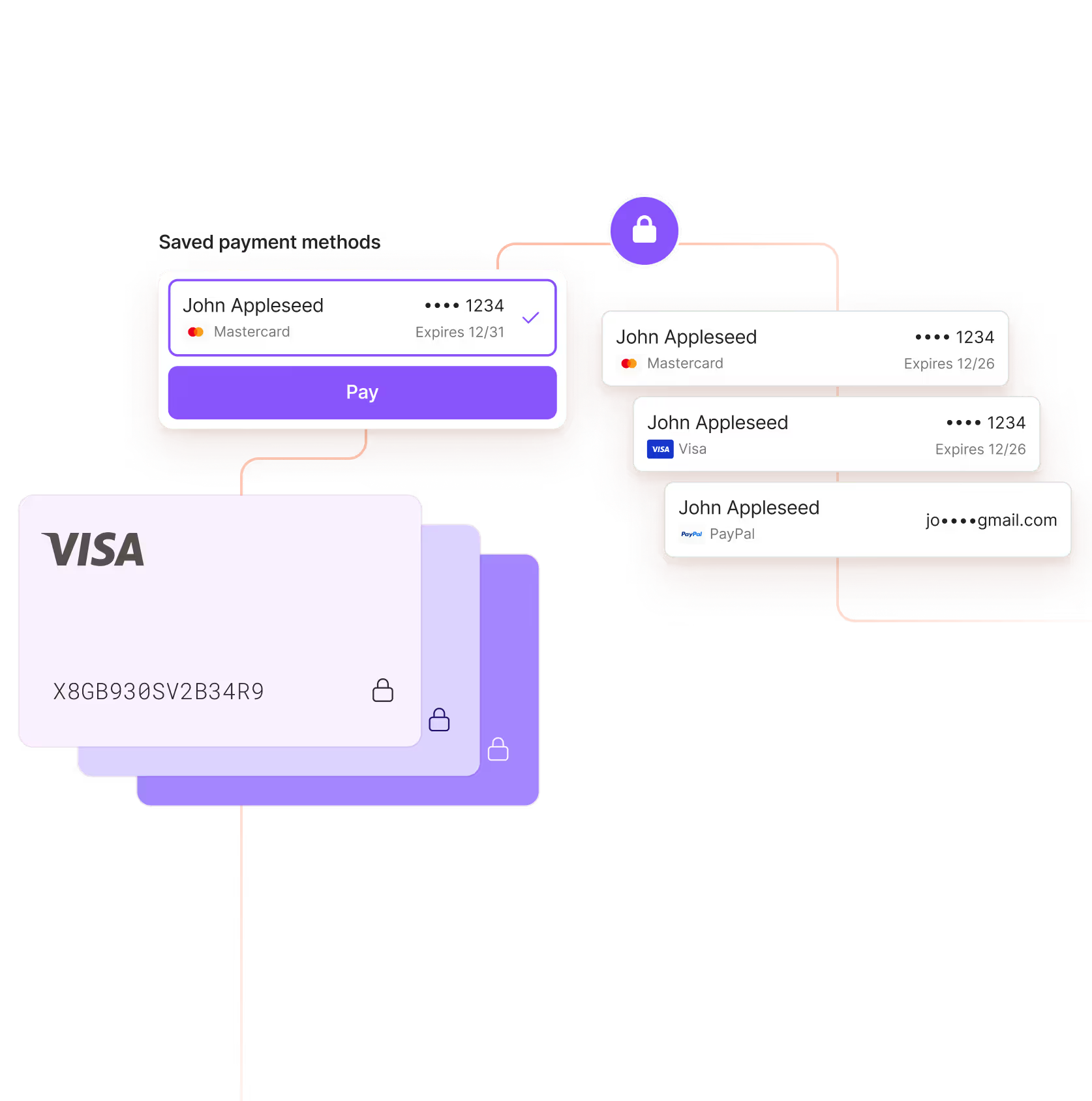

Bring every payment method into one vault you control

Unify and manage every payment credential in a single, compliant vault — built for control, speed, and scale across all flows and processors.

Proven. Trusted. Built for Scale.

All your payment data, one vault

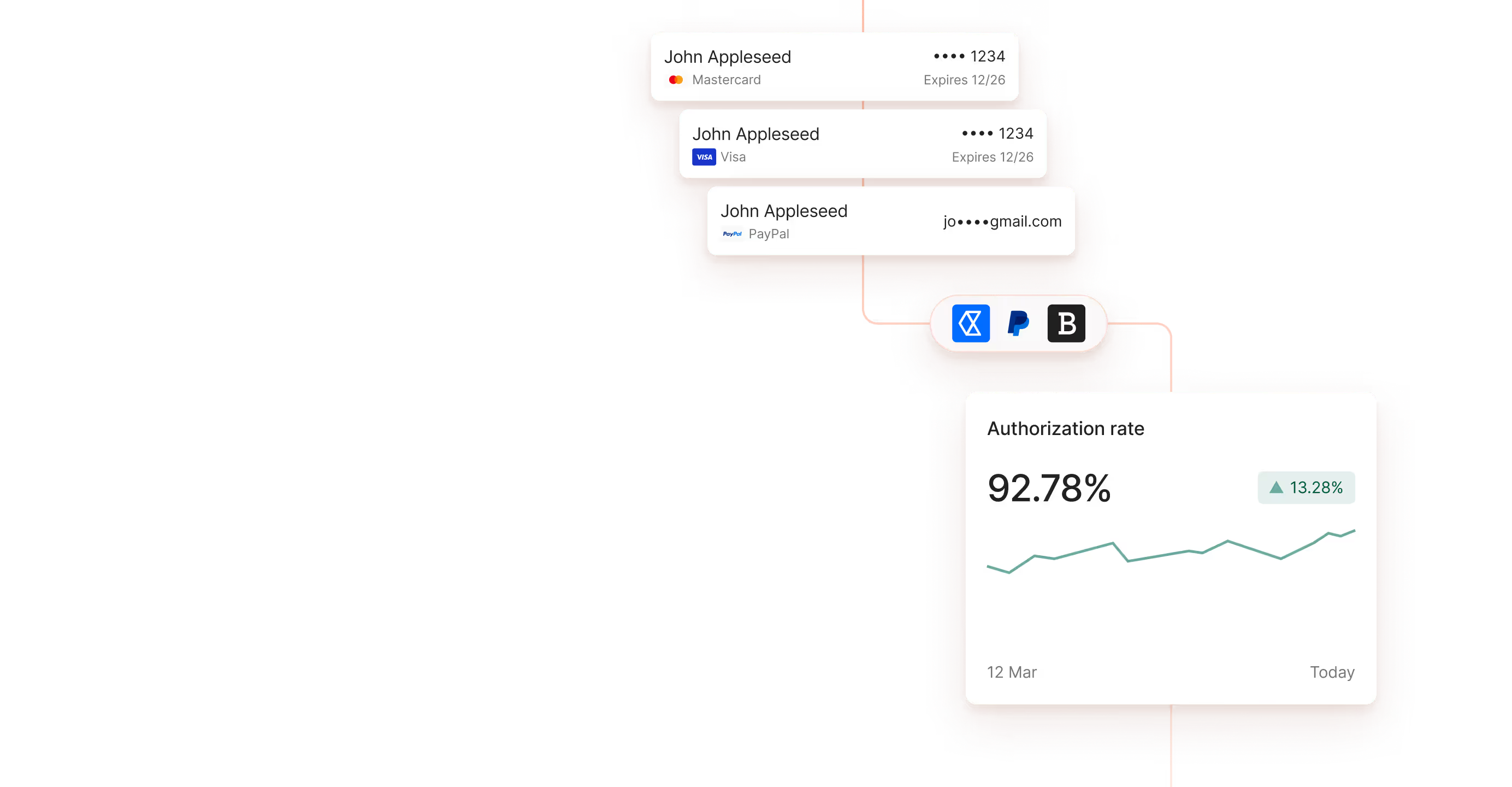

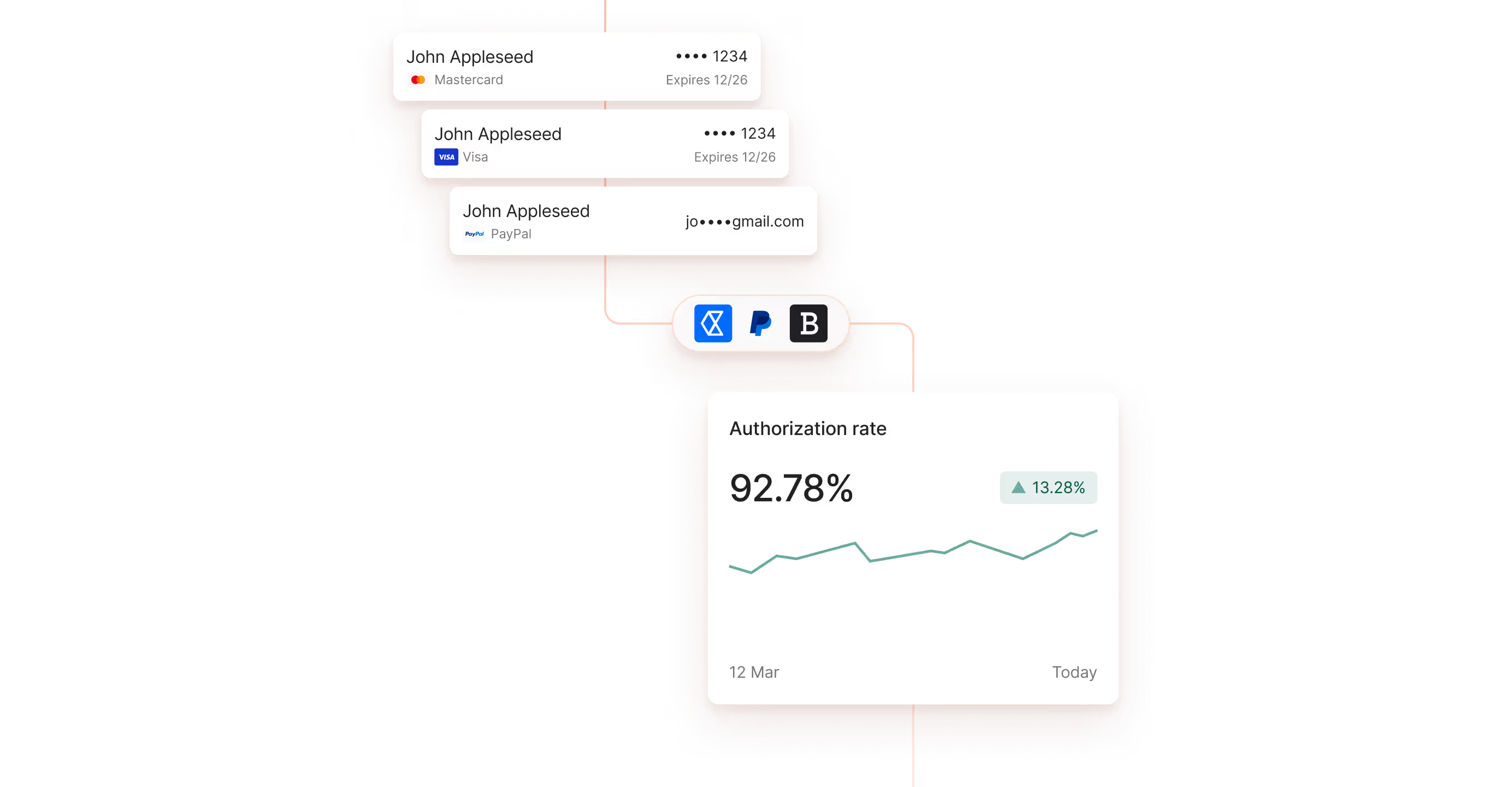

Maximize conversion,

minimize churn

Store and manage card data across all processors to reduce failed payments. Enable smooth one-off and recurring transactions that drive conversion and loyalty.

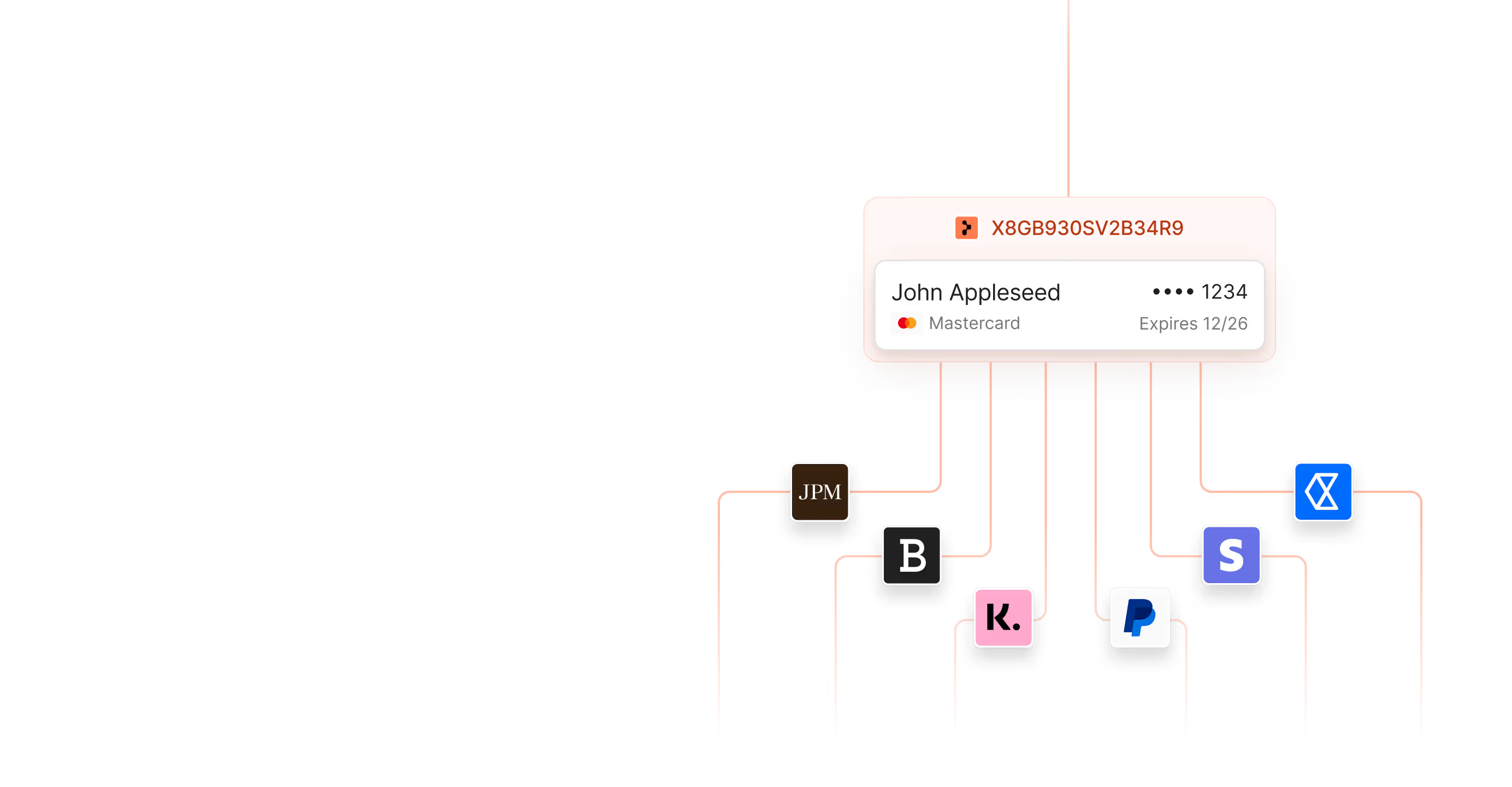

Tokenize once,

use anywhere

Eliminate fragmentation by storing tokens independently of your PSPs to route transactions across providers with full control and less headaches.

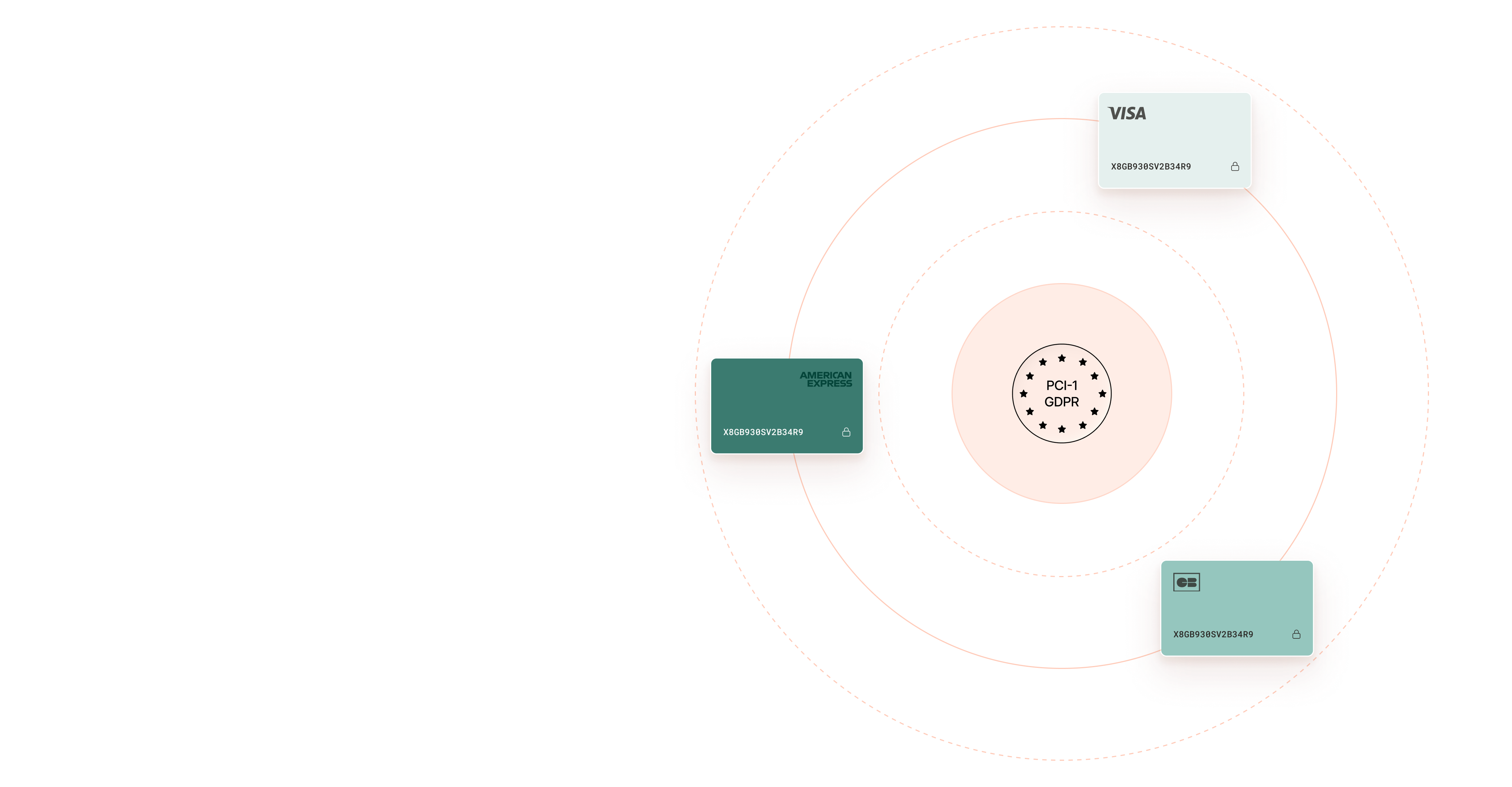

Protect customers,

keep compliant

Rely on PCI-DSS Level 1 infrastructure to safeguard payment data, cut operational overhead, and keep your business compliant.

Store, capture, and update customer information effortlessly

Fully agnostic

Capture, store, and forward payment details across any card scheme or processor - no lock-in, no constraints.

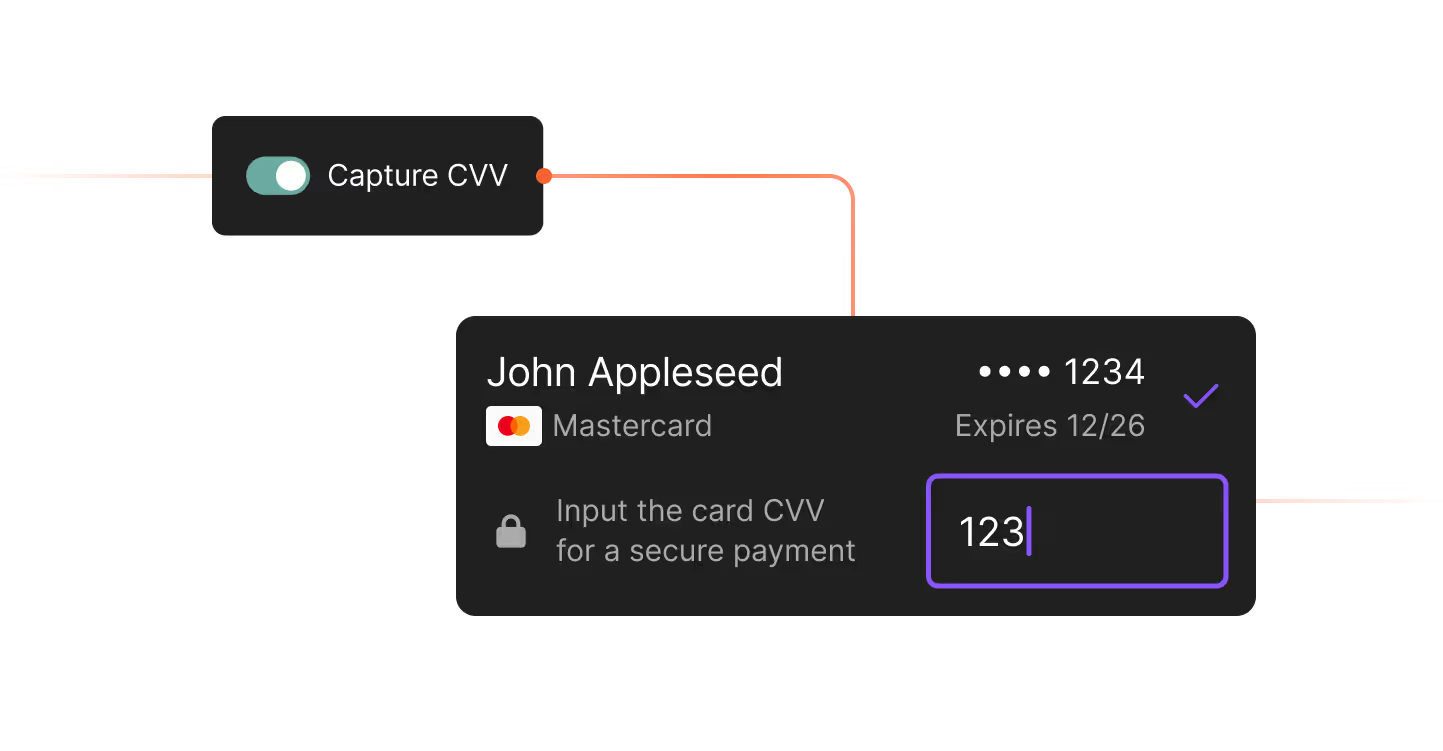

CVV recapture

Configure once in your workflow, and Universal Checkout handles the rest. Recapture CVV automatically on the web and mobile.

FAQs

Explore the Accept Suite

You’ve seen what

can do.

Now imagine what you could.