Recover lost revenue when payments fail

Automatically route failed or declined payments to a backup processor, giving you another chance to recover lost revenue and improve authorization rates.

Proven. Trusted. Built for Scale.

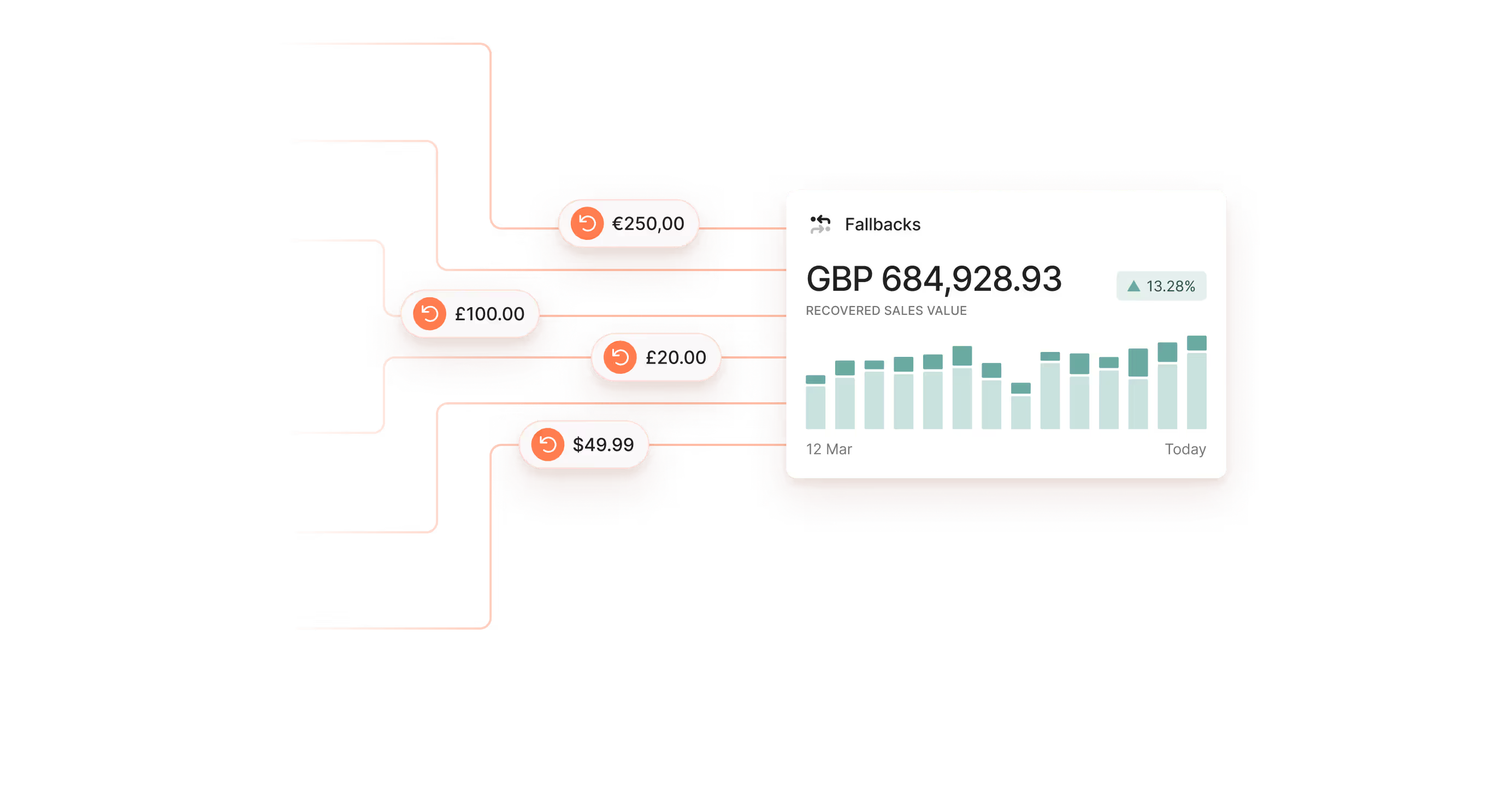

+38%

Average payment recovery with fallbacks

$410m+

In recovered payment volume

2X

Recovery within a week of activation

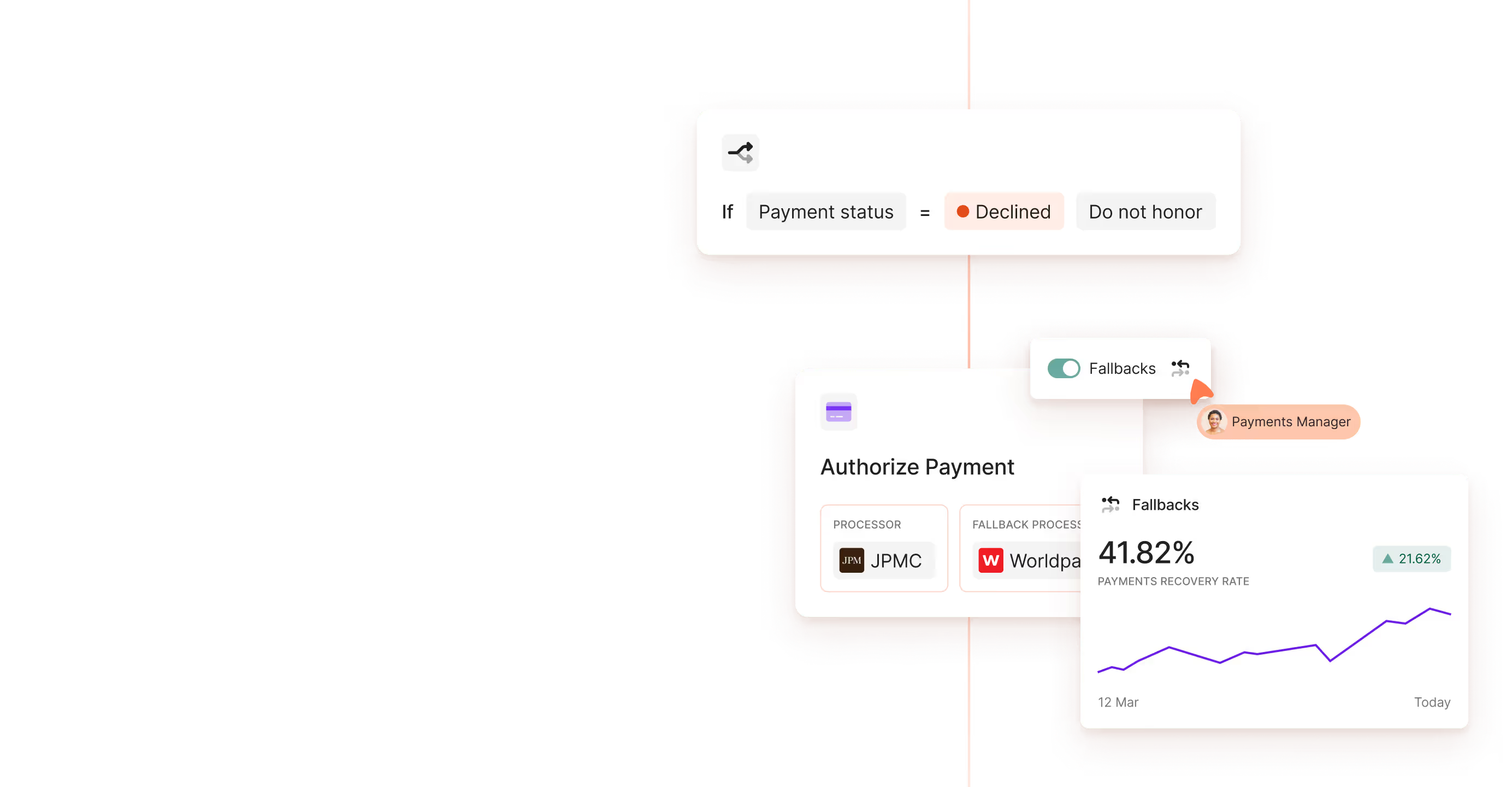

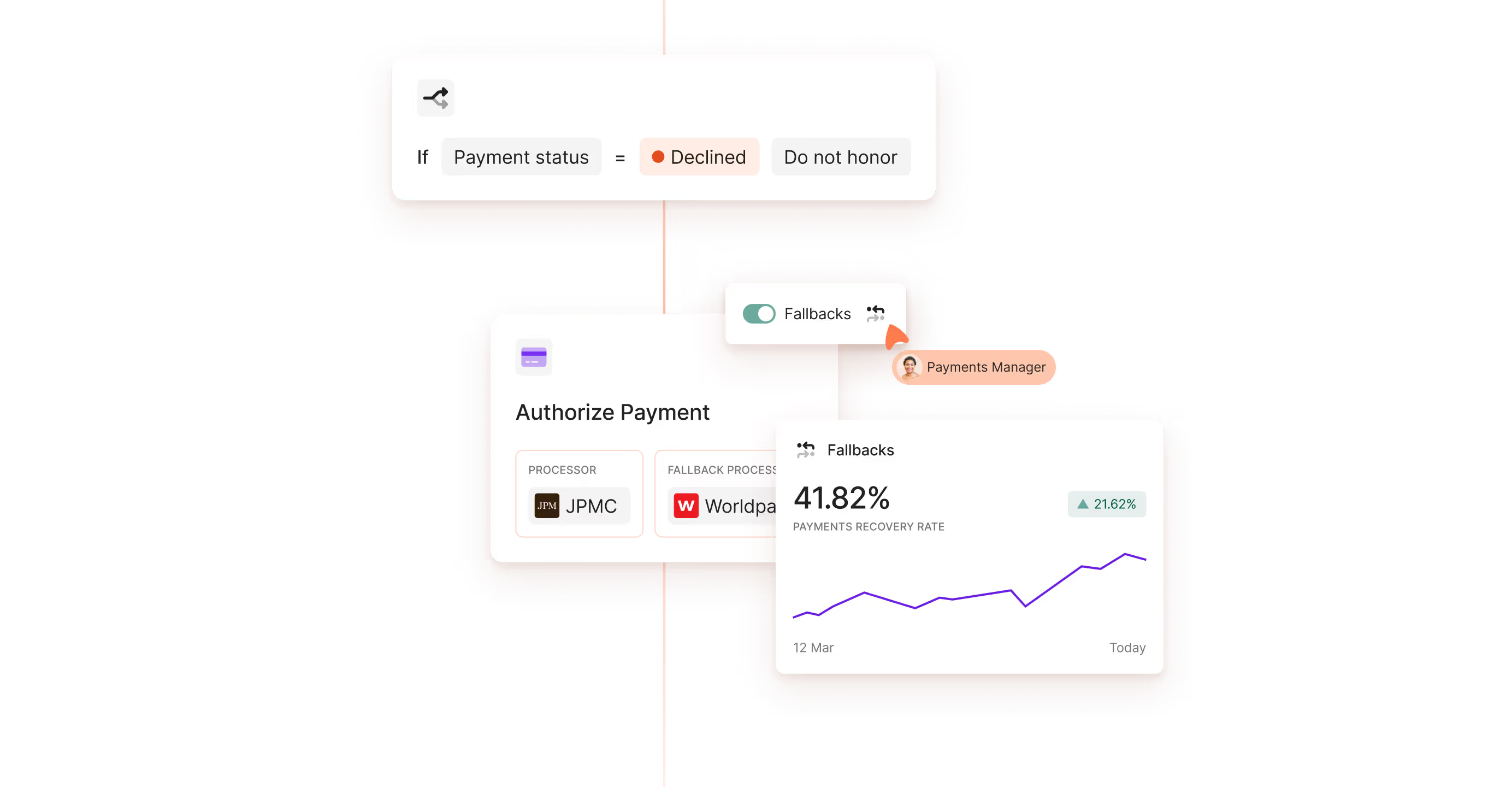

Never miss a payment

Never lose a payment opportunity

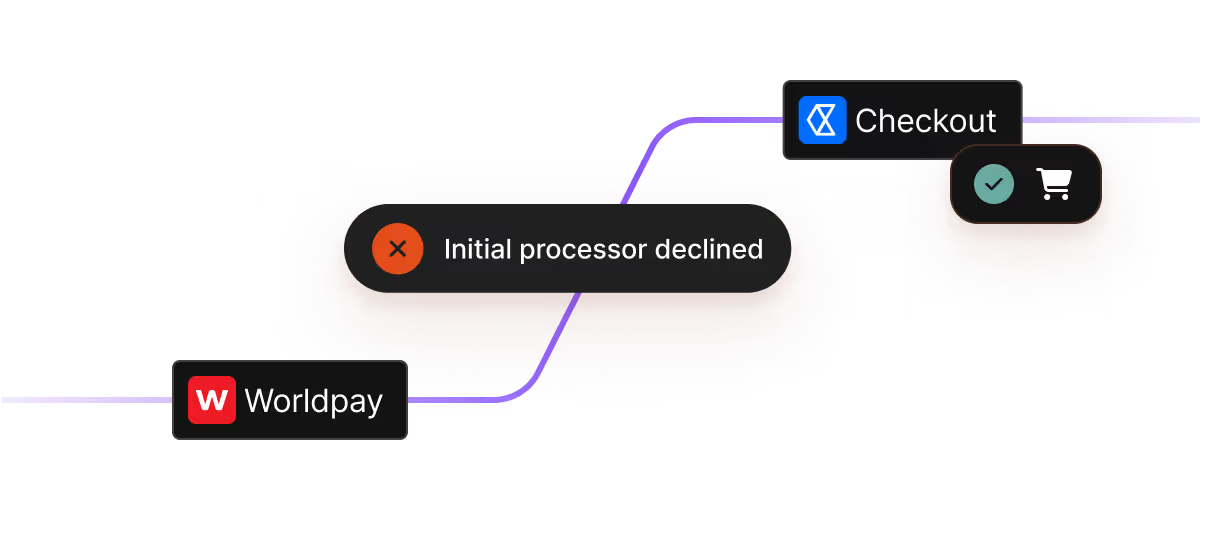

When your primary processor rejects a payment, Primer automatically retries through your chosen backup processor - no customer input, no disruption.

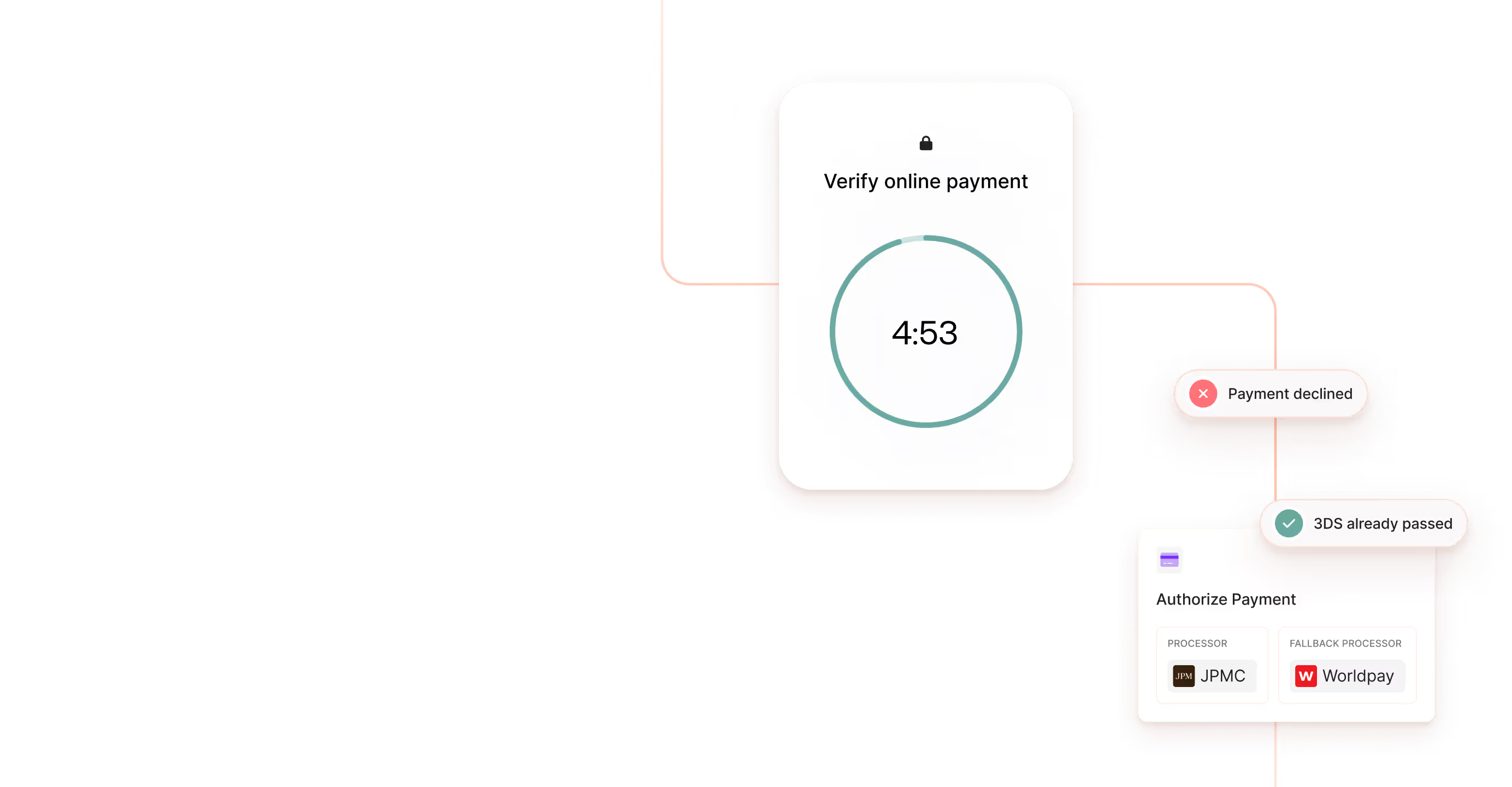

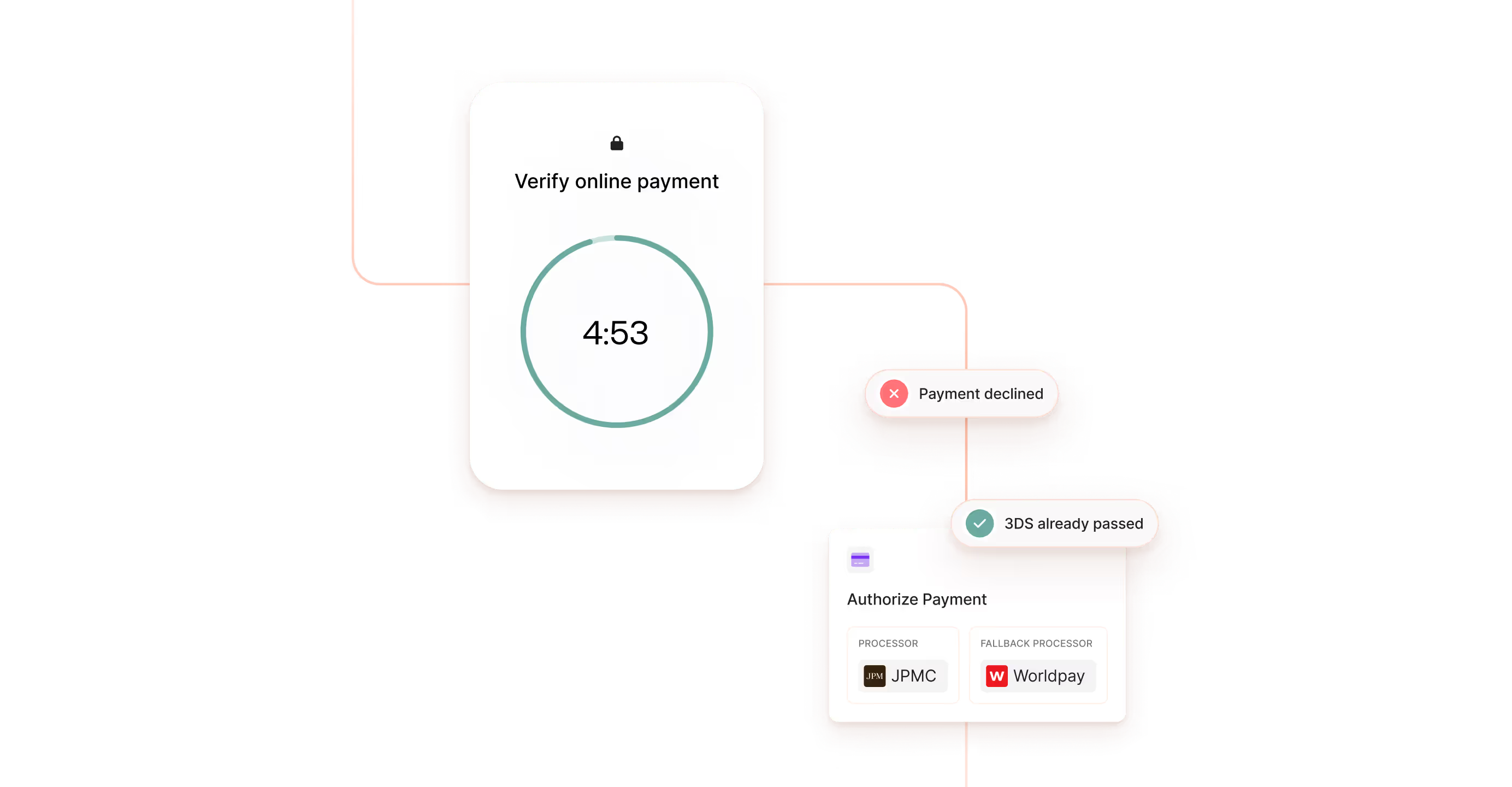

Authenticate once,

every time

Primer securely reuses 3DS data from the initial transaction, so your customers never need to re-authenticate.

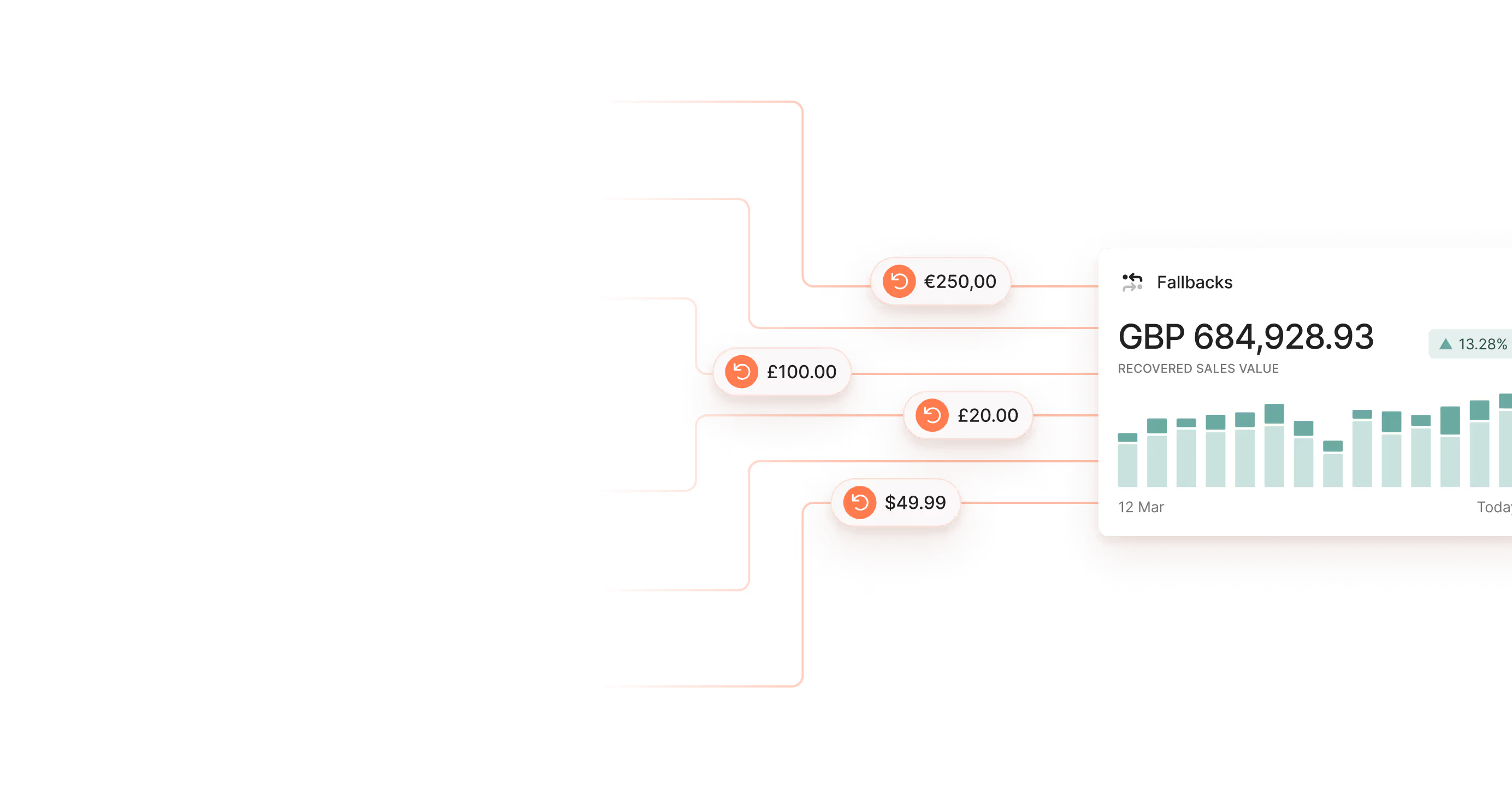

See every retry,

measure every recovery

Track fallback events in real time within the Primer dashboard, with full visibility into payment attempts, outcomes, and recovered revenue.

What Payments teams say

“We recovered over $7 million in revenue over six months uing Primer Fallbacks.”

Greg Rikkhachai

Former Head of Payments, Banxa

Make every payment count

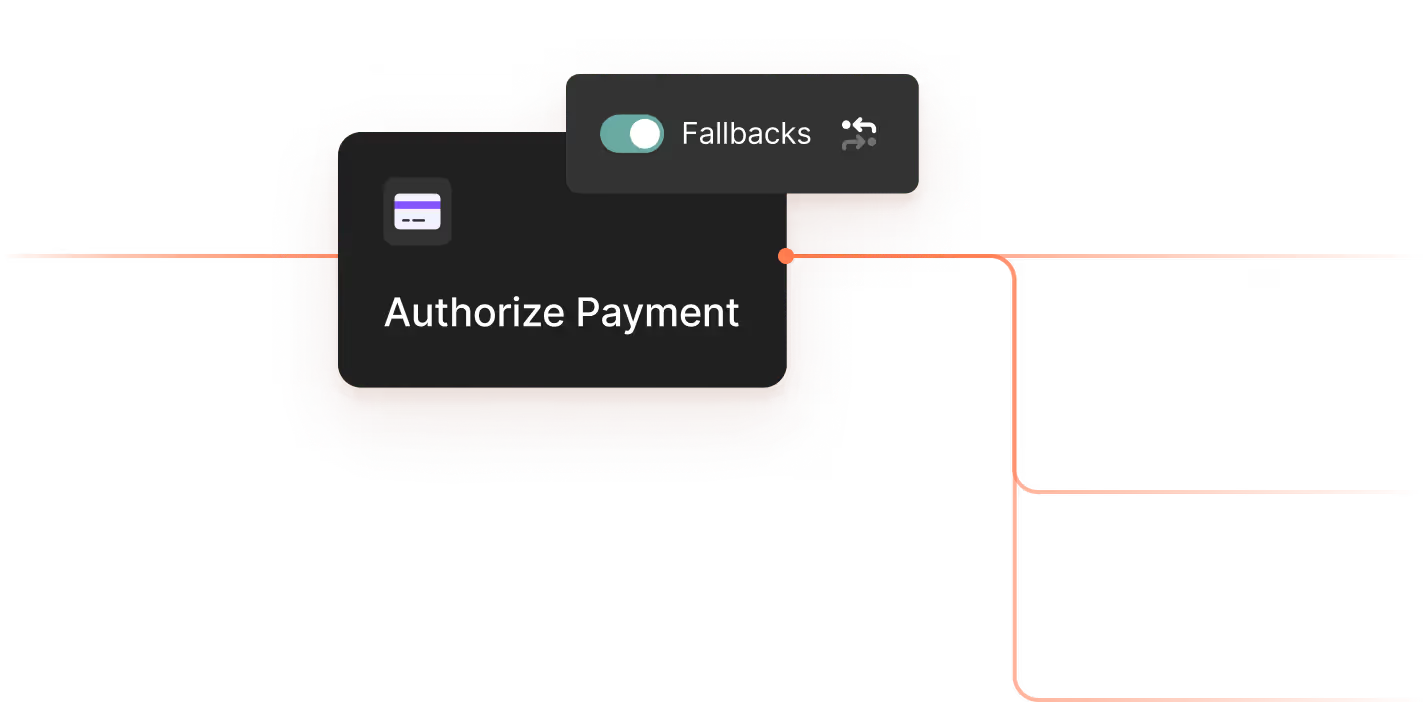

Go live in seconds, not weeks

Switch on Fallbacks in your workflow, choose backup processors, and recover revenue instantly.

Keep customers coming back

Automatically reattempt failed payments across payment methods to reduce churn and ensure every checkout succeeds.

FAQs

What is a fallback?

A fallback is a payment recovery mechanism that’s activated when the primary processor used by a merchant fails. If a merchant is using fallbacks, Primer will automatically divert the payment to a secondary processor, enhancing the likelihood of completing successful transactions.

Can I choose what processor to fallback to?

Absolutely, you have full control over selecting the primary processor for payment processing and determining the fallback processor to which transactions will be directed if needed.

Will my customer need to go through the 3DS flow when a fallback is triggered?

No. During checkout, your customer undergoes 3DS authentication, which is incorporated into the initial authorization request. Subsequently, when the fallback processor receives the second authorization request, the 3DS data is included, ensuring that the customer doesn't need to repeat the 3DS flow.

Explore the Optimize Suite

You’ve seen what

can do.

Now imagine what you could.