As Without A Fight thundered across the finish line, clinching the Melbourne Cup, the folks at Dabble, the innovative social betting app, weren't just cheering for the horses. They were also celebrating the business's success, which had just recorded its record single-day number of active customers, cementing its spot among Australia's top bookmakers.

Breaking into Australia's gambling market is no easy feat, let alone for a company that is only three years old. The market is one of the world's largest. It's also fiercely competitive and dominated by brands that have held the reins for years.

But Dabble isn't your typical betting app; it's a social media app with betting functionality. Users don't just come to place bets; they come to engage, discuss, and build communities around their favorite sports and wagers.

It's not just its unique offering that sets Dabble apart. Challenging conventions are embedded in its DNA. Across the board, its teams strive to set new standards, including with payments, which is why Dabble uses Primer's Unified Payments Infrastructure. It's allowing them to make payments an engine for growth across the business—as exemplified during the Melbourne Cup.

"The race is huge in Australia, and we have a huge spike in customers placing their bets with Dabble on the day," says Anthony Cugnetto, Head of Product—Core at Dabble. "But if any customers face issues while topping up their accounts, they might easily revert to the legacy players. That's the nature of the business; a frictionless experience is everything."

"Primer's ability to seamlessly handle the spike in volumes and deliver a 96% authorization rate in the build-up to the race was instrumental in our Melbourne Cup success."

Taking control of its payments infrastructure

The foundations that led to the success recorded over the Melbourne Cup were laid over the previous twelve months.

"Payments play a central role in Dabble's story," says Anthony. "The company has long acknowledged the importance of payments, especially as a tool for customer acquisition and retention. The challenge was utilizing payments as a catalyst for business growth while minimizing the overheads and complexities associated with expanding a payment stack."

The answer to that question was Primer.

"Our initial aim was to simplify managing and expanding our payments stack," Anthony explains.

"Primer enables just that. With a single integration, we have total control over our end-to-end payment flows. And, crucially, without utilizing developer resources, we can add new payment methods and processors, scale into new markets, and change our payment routing and logic on the fly."

And Dabble's been maximizing these capabilities. Since incorporating Primer in July, it's seamlessly integrated Apple Pay and Google Pay into its payment stack, with plans to include PayPal soon.

"Primer enabled us to activate these methods at lightning speed, whereas making a direct integration would have taken our developers away from focusing on building innovative features," Anthony emphasizes.

"Especially as we simultaneously onboarded multiple new payment processors at the same time," he adds. "It was an important goal for us to build redundancy in our payment stack and start dynamically routing our volumes across processors to boost authorization rates and lower costs."

Driving optimizations across the board

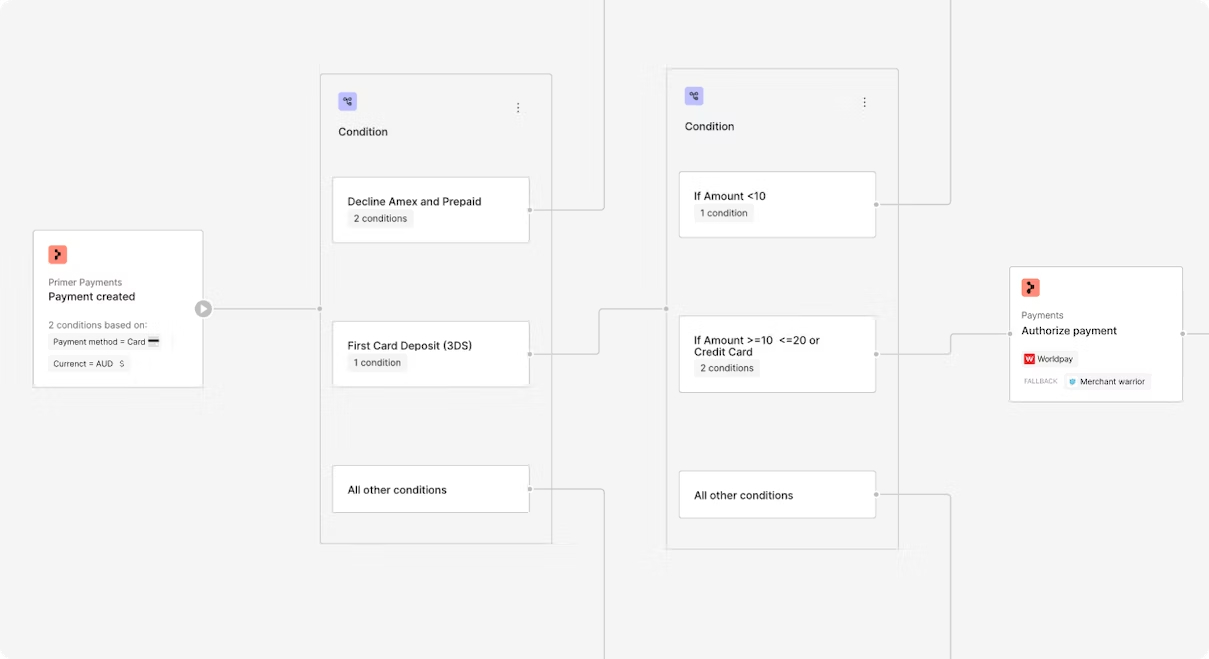

With a range of new payment methods and processors enabled through Primer, Anthony focuses most of his efforts on experimentation and optimizing Dabble's payment flows.

"My primary goals revolve around enhancing authorization rates and fortifying our defenses against fraudsters," he explains. "Primer equips me with the tools and frameworks to achieve these objectives."

For instance, in November 2023, Anthony set up Fallbacks to automatically retry failed payments through another processor. In just over a month, Dabble recovered over $70,000 (AUD) in revenue that it'd otherwise have left on the table. "This is a meaningful amount of revenue we're recovering with little to no effort," he says.

Aside from Fallbacks, Anthony is a self-described power user of the Primer platform, spending his time building workflows, tweaking processing logic, and running experiments.

"It's incredibly intuitive to create workflows in Primer," he says. "And there's a lot of flexibility. For instance, I can choose when we trigger 3DS at the BIN level. This functionality allows me to find marginal gains to optimize our overall authorization rate."

His confidence in the product is evident; Anthony even admits that he edited a workflow in the critical hours running up to the Melbourne Cup. "I identified an opportunity to alter our use of 3DS across specific BINs that I believed would enhance our performance," he says. "So I jumped into the platform, made the change, and we realized a small, but not insignificant, improvement in our authorization rate. And I knew I could roll back immediately if it didn't work."

Anthony has also started to utilize additional third-party applications in Dabble's workflows. For instance, he's set a rule that sees him receive a Slack message when a payment declines due to suspected fraud.

"Receiving real-time alerts in Slack allows our team to be more proactive in dealing with issues as they arise," Anthony says. "The alternative is being reactive when we find these issues in reports after the fact, at which point we could have already lost revenue. And this is just scratching the surface. I see much more potential to optimize how we operate as a team and manage our payments by embedding third-party apps into our payment flows."

Doubling down on creating value with payments

Not only has it solidified itself as one of the biggest bookmakers in Australia, but it’s also made its first foray into the US.

Its early success is remarkable. Six weeks after launching, Dabble was fourth in the app store's sports betting and daily fantasy category.

“Primer has been a big part of this next step in our journey,” says Anthony. “It allowed us to quickly integrate with the two new processors, Nuevi and Checkout.com, we needed to operate in the US. All we had to do was switch the processing currency and build a few new workflows. The reality is without Primer, we wouldn’t have launched anywhere near as quick as we did.”

And it's just getting started.

Looking ahead to what's to come, Anthony is focused on utilizing more Primer functionality. "Network tokens are another solution that's top of mind and something I'm interested in exploring with Primer to continue optimizing and enhancing our payment performance."

Get in touch to learn how Primer can help make payments a strategic growth level in your business.