If you’re doing research on payment routing, you may be faced with the following challenges:

- You currently work with multiple payment processors and want to optimize payment flows to decrease costs and increase authorization rates.

- You want to understand how to set up payment routing dynamically so your payments are automatically processed in the most efficient way.

- You’re looking for a payment orchestration provider that can help you easily set up and manage your payment routing.

Payment routing helps you, as a business, have better control over your payment flows while lowering processing costs, increasing approval rates and offering a much better customer experience.

Let’s explore payment routing in more detail, looking at:

- What you need to know about payment routing

- What are the types of payment routing?

- The advantages of smart payment routing

- How Primer helps merchants implement payment routing

- How Ferryhopper used Primer to increase conversion rates and recover bookings with better payment routing

Note: looking to set up payment routing right away? Book a call with our team to see how Primer can help you with payment routing.

What you need to know about payment routing

Payment routing is the process of determining the most efficient and secure path for the payment once a customer presses pay. The optimal path depends on factors like where the transaction happens, the transaction's value, and the items bought.

Until recently, payment routing was a manual and resource-intensive process for payment leaders. It required development teams to build integrations with different payment service providers (PSPs) before developing complex routing logic on top to determine the ideal payment route.

But now, by working with payment orchestration providers, merchants can consolidate various payment integrations on the back end through one API, eliminating most of the manual processes and development resources required to adopt a multi-processor payment strategy.

These platforms can help you easily create payment-routing workflows with drag-and-drop functionality and the ability to add conditions such as including 3DS, completing a fraud check or creating a JIRA ticket – all in a few clicks. The platforms make building a complex and optimal payment routing strategy available to any business.

What are the types of payment routing?

Reviewing the types of dynamic payment routing is like taking a history lesson in payment innovation more broadly. Let’s look at how payment routing has developed over the years.

First generation: Single acquirer

In this initial phase, merchants relied on a single acquirer or payment gateway for payment processing. Despite having a solitary route to follow, payment routing was still at play.

Second generation: Static payment routing

As merchants began to onboard multiple acquirers, they faced the challenge of hardcoding routing logic into their backend systems. This manual configuration process typically demanded developer expertise, making it difficult for merchants to make quick changes without returning to the development roadmap. Consequently, if a provider experiences downtime or encounters low payment authorization rates for a particular card type, swiftly switching to an alternative provider isn't possible.

Third generation: Smart routing

Innovative platforms like Primer emerged to help merchants reap the benefits of payment routing without grappling with its complexity. These platforms equipped merchants with the capability to implement payment routing strategies on a global scale without code to optimize payments.

It’s been a game-changing development offering merchants and payment leaders comprehensive control over their global payments. Doing so has enabled them to channel their efforts using payments as a strategic driver within the business.

Terms such as "intelligent routing" and "dynamic routing" are often used interchangeably with "smart routing" to describe this latest generation of payment routing.

Fourth generation: Smart routing enriched by AI

In the most recent evolution of intelligent payment routing, the power of AI and machine learning takes center stage, offering merchants an automatic boost in authorization rates.

These solutions harness the network effect, analyzing billions of data points generated from millions of transactions to pinpoint the optimal route for every transaction. And all this can happen with no merchant involvement.

The advantages of smart payment routing

Lower transaction costs

Businesses can reduce processing fees by intelligently routing transactions through the most cost-effective payment channels.

Enhanced approval rate

With the ability to analyze various factors such as payment methods, geographic locations, payment providers and risk profiles, smart routing increases the likelihood of successful transaction approvals.

Improved customer experience

Customers benefit from smooth and reliable payment experiences. Smart routing minimizes payment failures and reduces the number of declines, enhancing overall satisfaction.

Lost revenue recovery

By rerouting transactions in real-time using fallbacks, businesses can recover revenue that would otherwise be lost because of failed transaction or payment declines.

How Primer helps merchants implement smart payment routing

Primer equips merchants with the payment tools to optimize payment processing performance, build at pace, and capture untapped revenue via a unified payments infrastructure.

Payment routing is one of the core use cases merchants use Primer, and here are a few reasons why:

Implement as many processors as required easily with no-code functionality

One of the key challenges of integrating with a new acquirer is that it takes up a lot of valuable engineering time and resources. Your engineering team has to do the research on how to integrate with the payment solution and then actually implement it and get it to work with your existing payment processes and flows. This means taking time away from other priorities to then focus on payments.

With Primer, integrating with a new acquirer can be done with a click of a button. You just need to integrate with Primer once, and you’ll be able to start working with a range of local and global payment processors.

We’ve built a unified schema that is applied to all the different processors. Having to do a direct integration with Adyen, Stripe and Braintree, for example, would require integrating with three different API schemas. With Primer, it all happens via one API.

Say you wanted to add Airwallex as a processor. You’d just need to head to your Primer Dashboard, go to the integration section, search for their name, and follow the instructions to integrate with them (either via a log-in or adding an API key) and you can start processing payments right away.

The fact that it’s so easy to integrate with new acquirers allows your company to complete key business activities—such as expanding to a new country—a lot more quickly and with very little engineering resources.

Build out payment processing flows in no code and based on highly specific attributes

Before payment orchestration platforms existed, if you wanted to fully enable payment routing you needed specialized engineering resources to create payment routes based on specific circumstances. But payments are likely not your core competency, so it’s a waste having engineering resources focused on it when they could be working on the product.

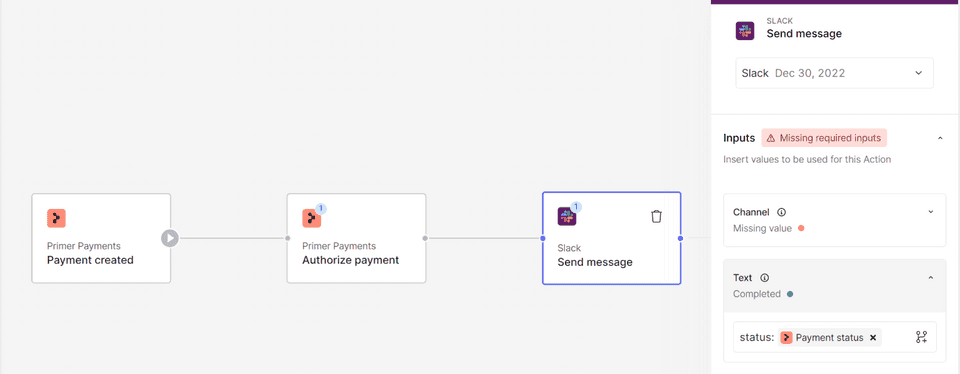

Using Primer, you can build entire payment flows via no-code. When a payment is created, you can tell Primer to trigger a particular workflow and define the conditions and rules for that transaction. For example, if a payment has a specific customer ID, you can tell Primer to run a workflow, to enable or disable 3DS, or to use a specific payment option specific to a region.

Consolidating all your PSPs through a single integration also allows you to have a lot more commercial control and more easily compare costs between processors, while the onboarding costs remain low. It also allows you to A/B test your hypothesis and best optimize your payment flows.

And finally, having the right payment workflows set up can also help with de-risking your payment processes, so if one PSP has an outage you can quickly route payments via other PSPs.

Easily analyze processor performance and make data-backed decisions

If you integrate with multiple processors and want to analyze the data, you’ll have to open each PSP portal account individually to track performance. It takes time to do, and because all the data is siloed you don’t get a clear picture of what processor is performing the best and when.

With Primer, you can use our Observability platform where you can see all your payment data across PSPs in one place.

You can also slice and dice the data in any way necessary. For example, you can look at your overall authorization rate across the past 30 days, or see what your acceptance rate is specifically for a processor like Stripe or Adyen. If, for example, you see that certain payments do better via Adyen, you can then decide to route payments through Adyen at a click of a button.

You can also analyze the data based on BIN numbers, decline reason, MIDs and more, allowing you to optimize processor performance or detect and mitigate a spike in declined payments, for example.

A payment routing solution only works as well as your data. If you don’t know what is and isn’t working well, you can’t route payments in the most efficient way. With Primer, you can easily see a breakdown of authorization rates allowing you to make optimizations that could have a major impact down the line.

Set up automatic fallbacks to help increase authorization rates

One of the key features of payment routing is fallbacks: if a payment fails, you want to have another processor ready to process that payment to not lose the customer.

Setting up fallbacks manually is highly complex: you need to understand and set up the logic of when to be able to retry a payment for a second PSPs. Not only do you have to set up the integrations yourself, but you need to understand the various codes that come back and what they mean. For example, attempting to retry a hard decline payment can lead to fines from the schemes.

With Primer, you don't need to worry about all this complexity. It has mapped and standardized the decline codes used by all PSPs, meaning that eligible payments are automatically retried through our chosen fallback processor.

Having fallbacks in place not only increases authorization rates but it’ll allow you to offer a much better customer experience to your buyers and recover lost revenue. For example, Banxa, a global leader in crypto infrastructure, was able to achieve a 22% success rate, recovering US$7 million in revenue so far in 2024 with Primer’s native Fallback functionality.

How Ferryhopper used Primer to increase conversion rates and recover bookings with better payment routing

Ferryhopper is an online travel agency (OTA) transforming ferry travel. It allows travelers to compare and book tickets with over 100 ferry operators and 500 destinations.

At the beginning of its payments journey, Ferryhopper would direct customers to a checkout form on its bank’s website to complete payment. But this led to little visibility on what customers were doing at checkout and little ability to optimize for cost and performance.

As the company matured, the team realized they needed to use a third party to help manage the integrations with various processors, and eventually partnered with Primer.

Today, Primer helps Ferryhopper minimize customer friction with Dynamic 3DS and optimize for cost and performance with Workflows via custom payment routing.

With Dynamic 3DS, Ferryhopper can be sure that 3DS is only prompted for payment transactions falling under the scope of SCA. This allowed them to increase their conversion rate by 2%.

"Additionally," Konstantinos Kontos, Payments Product Lead at Ferryhopper, points out, "Primer has extended this feature to request a 3DS challenge for specific transactions made through GooglePay, even when they don't inherently meet the SCA requirements. This has effectively prevented 20% of our customers who used Google Pay from having their payment declined."

With Workflows, Ferryhopper was able to set up smart payments routing to direct payments to the optimal providers.

"Crafting these workflows and implementing conditioning logic has proven to be remarkably straightforward, especially with the outstanding training we received from the team," says Kontos.

They were also able to apply automated fallbacks, which saw them recover 1% of bookings.

"Our collaboration with Primer signifies a significant stride in its quest to become the global ferry expert," says Ferryhopper’s CPO and Co-founder, Panagiotis Sarafis. "Using Primer to streamline our operations, enhance our customer experiences, and optimize performance has turned payments into a strategic growth level for our business."

Read more about how Ferryhopper use Primer here: Charting a new course for payments at Ferryhopper

The right payment orchestration platform is key to getting payment routing right

By embracing smart payment routing strategies, your company can ensure seamless and secure online payments, unlock substantial cost savings, improve customer satisfaction, and enhance efficiencies.

The right payment orchestration platform will allow you to easily visualize and execute on payment flows in a way that doesn’t require extra engineering resources, as well as give you deep insights into your payment processing performance.

Book a call with our team to see how Primer can help you with payment routing.

Payment routing Frequently Asked Questions (FAQs)

What is payment routing and why is it important?

Payment routing is the process of choosing the most efficient path for a transaction to reach approval, based on factors like card type, geography, and transaction value. It helps businesses reduce costs, boost authorization rates, and improve the customer experience by minimizing failures and delays during checkout.

What are the different types of payment routing?

Payment routing has evolved in four key phases:

- Single acquirer routing: A basic setup using one processor.

- Static routing: Hardcoded logic to route payments to specific acquirers.

- Smart/dynamic routing: No-code platforms allow businesses to route payments flexibly based on custom rules.

- AI-enhanced routing: Uses machine learning to identify optimal routes based on large-scale transaction data with minimal manual input.

How can smart payment routing improve business performance?

Smart routing can lower processing fees, increase authorization rates, and recover lost revenue by rerouting failed transactions in real time. It also creates a better customer experience by reducing declines and offering more reliable payment options.

How does Primer simplify smart payment routing?

Primer allows merchants to integrate with multiple PSPs using one API, build customized payment flows with no code, and monitor all payment data in a centralized dashboard. Merchants can A/B test processors, implement fallback logic, and make data-backed decisions to optimize payment performance.

What kind of results can merchants expect with Primer’s payment routing?

Businesses using Primer have seen significant improvements in payment performance. For example, Ferryhopper increased its conversion rate by 2% and recovered 1% of lost bookings through fallback routing. Primer’s dynamic 3DS and smart routing helped reduce Google Pay declines by 20%, showing clear ROI through optimized payment operations.

.png)