What are co-badged cards?

A co-badged card is a debit or credit card that can be processed on more than one card network. If you want a quick refresher on what card networks are and how they work, refer to our blog article:What are card networks and how do they work? In most cases, it combines:

- a global network like Visa or Mastercard

- a local network like Cartes Bancaires (France), Dankort (Denmark), or eftpos (Australia)

Some regions have specific requirements that must be implemented to be compliant with local regulations.It is your responsibility to meet these compliancy criteria.

Co-badged vs co-branded cards

These two concepts are often mixed up, but they are very different.-

Co-badged card

A card that supports multiple payment networks (for example Cartes Bancaires + Visa).

This affects checkout behavior and is regulated in some regions.In some regions, co-badged cards are also referred to as dual-network cards. This terminology is commonly used in Australia. -

Co-branded card

A card that combines one payment network with a commercial brand (for example an airline or retailer).

This is about loyalty and issuing, and has no impact on checkout or compliance.

Where do co-badged cards exist?

Co-badged cards mainly exist in countries with strong local card networks.Europe

- Cartes Bancaires (France) co-badged with Visa or Mastercard

- Dankort (Denmark) co-badged with Visa or Mastercard

- Bancontact (Belgium), sometimes co-badged with Visa

Australia

- eftpos co-badged with Visa or Mastercard

Other regions

- mada (Saudi Arabia)

- elo (Brasil)

Not all local networks are available for online payments, and not all of them are supported by every processor.

How co-badged cards work in practice

When a shopper enters their card details:- The card number is analysed to detect which networks are available.

- Depending on the country and local regulation:

- the shopper may be asked to choose a network, or

- the merchant or payment platform selects one automatically.

- The payment is authorised and processed using the selected network.

Regulation

Europe – giving the shopper a choice

In the European Economic Area, co-badged cards are covered by Regulation (EU) 2015/751. Key things to remember:- You are not required to support local card networks.

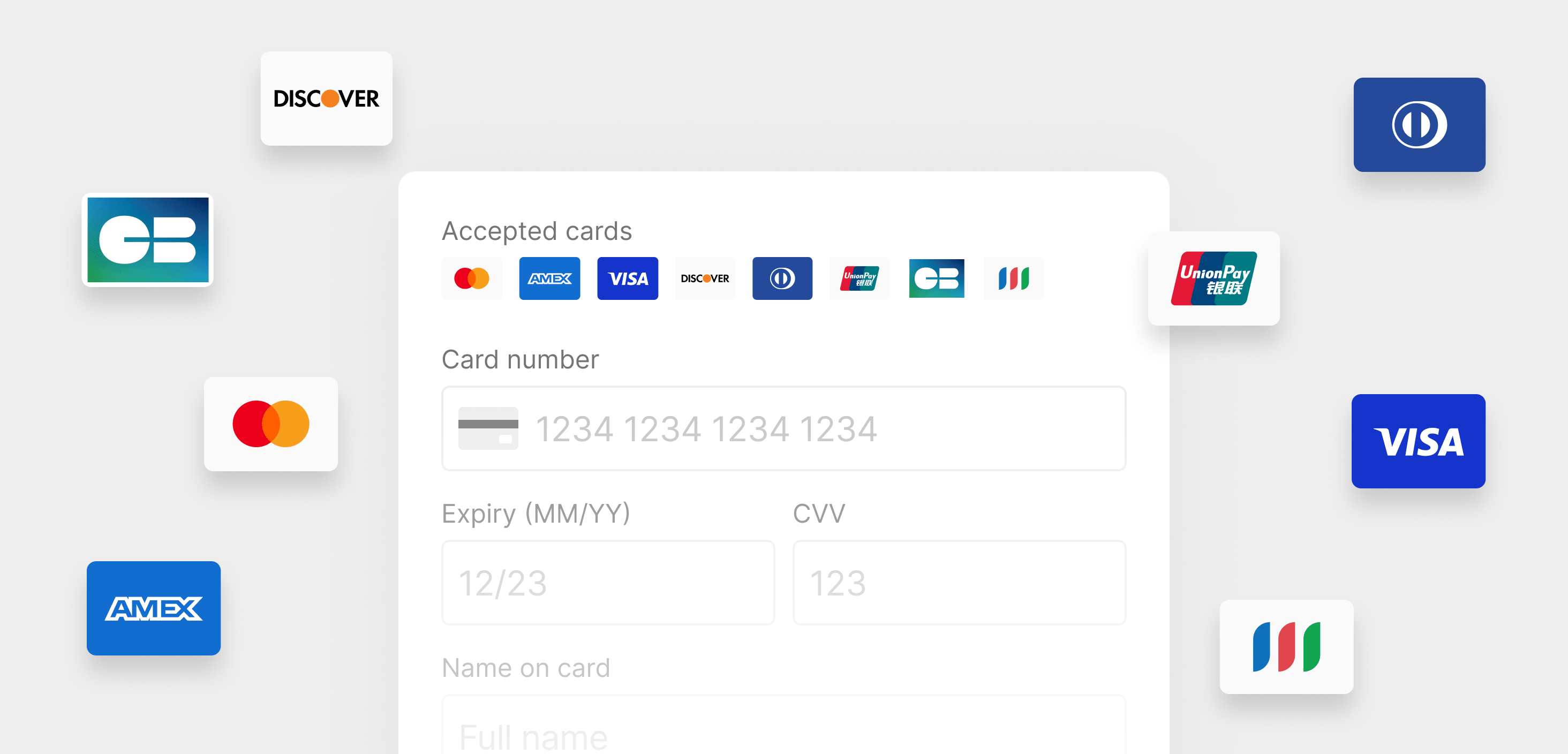

- You must clearly communicate which card networks you support, for example by displaying the logos of all supported schemes at checkout.

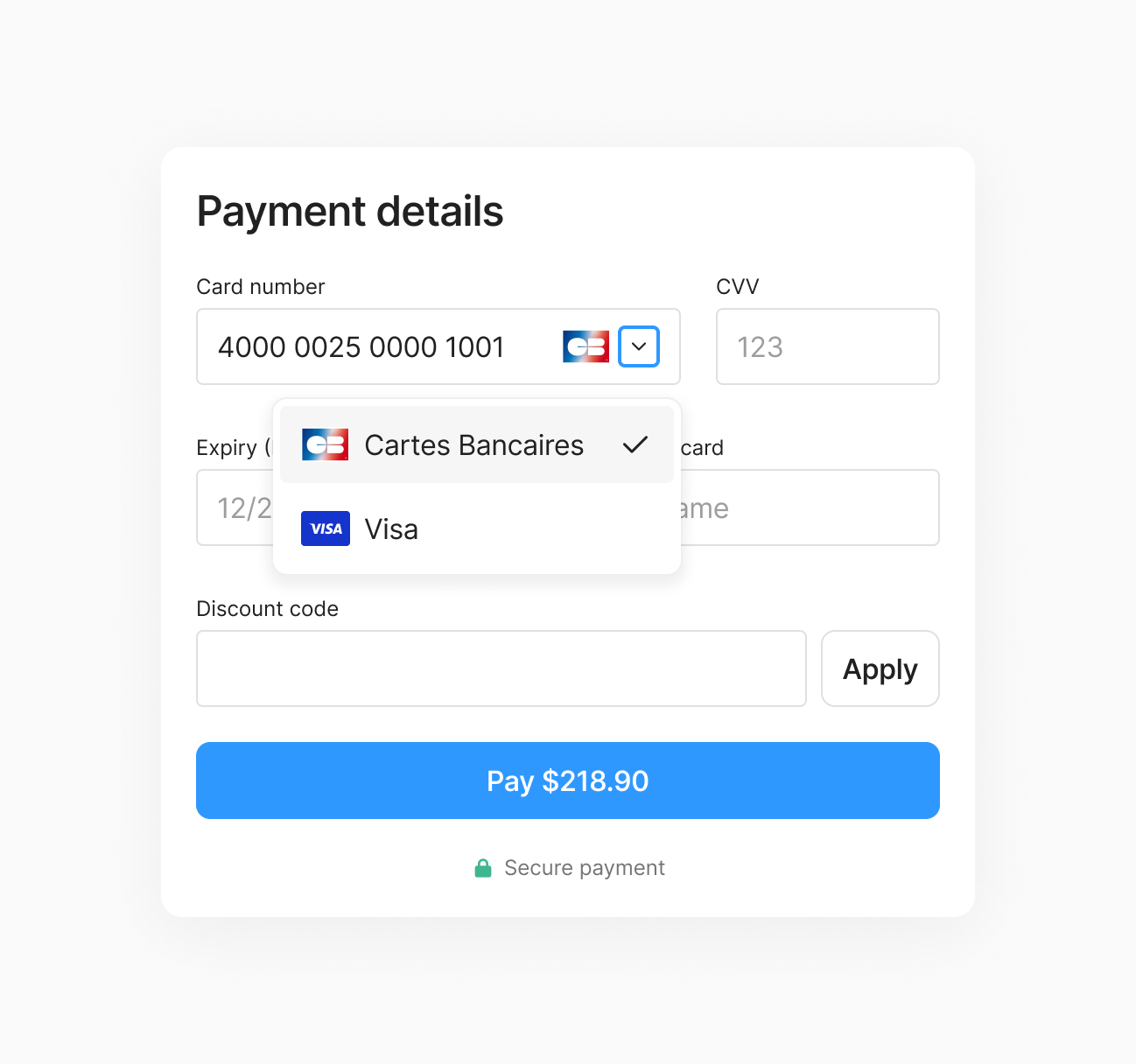

- If you do support multiple networks available on the same card, you must let the shopper choose.

- You can preselect a default network, but you must respect the shopper’s choice.

- For saved cards and recurring payments, the original choice must be reused.

If you support both Cartes Bancaires and Visa, and a French shopper uses a co-badged card, your checkout must clearly let them choose between CB and Visa. Frontend impact

- The choice must be visible and easy to understand

- Network logos and labels must not be misleading

Are you meeting the EU’s co-badged card requirements?

New: our new Primer Checkout natively supports the display of a co-badged card selector.Don’t hesitate to have a look and play with our showcase:

Primer Checkout Showcase

Australia – merchant routing behind the scenes

Australia follows a different model for dual-network debit cards such as eftpos.Key differences

- You are not required to present a card network choice to the shopper.

- If the shopper is not explicitly given a choice, you can control routing and apply your own default rules (for example least-cost routing).

- If the shopper is explicitly given a choice and makes a selection, this choice must not be overridden.

- You must not mislead the shopper about which card networks may be used.

Example

A shopper sees a Visa debit card in the UI.Because no explicit network choice is presented, you apply your default routing rules and process the payment via eftpos in the background. This approach is commonly used in Australia to avoid exposing eftpos branding, which may be unfamiliar or confusing for shoppers, while still optimising routing and costs.

Regulatory references

For more details, refer to the Reserve Bank of Australia guidance on dual-network debit cards and least-cost routing: Dual-network debit cards and mobile wallet technologyWhy support co-badged cards?

Co-badged cards let you accept local card networks without adding complexity to your checkout. In markets where local schemes matter, this can make a real difference, both on cost and performance. By supporting co-badged cards, you can:- Reduce processing costs by routing transactions through local networks when available

- Improve authorisation rates with rails optimised for local issuers

- Increase acceptance by supporting the payment methods shoppers trust most in their country

- Stay compliant by design with regional card regulations, without custom work