Quickstart guide

1. Connect a processor

Choose and connect your preferred payment provider in just a few clicks.

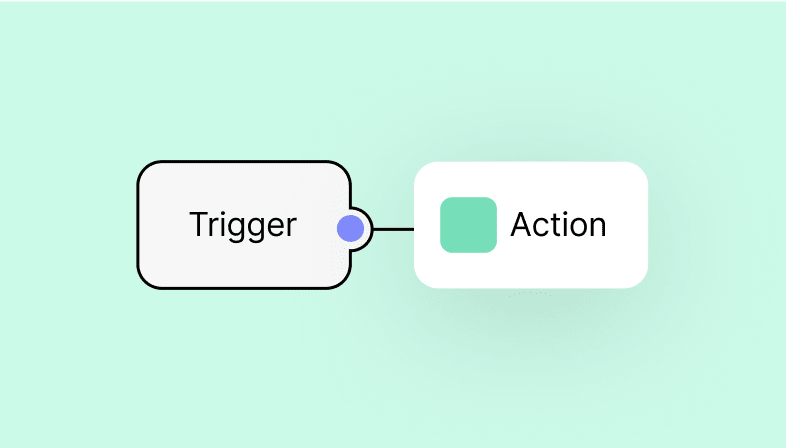

2. Create a workflow

Build automation to route payments, handle errors, and trigger downstream actions.

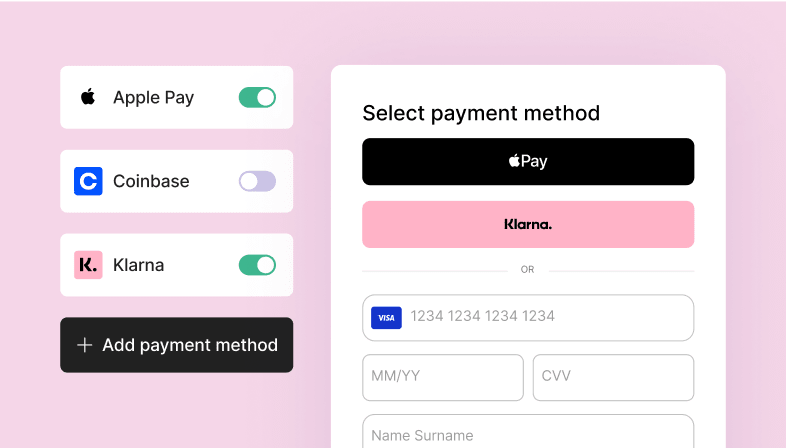

3. Set up universal checkout

Customize and launch a flexible checkout that works across devices and regions.

4. Set up payment updates

Keep your systems in sync with real-time status updates via workflows or webhooks.

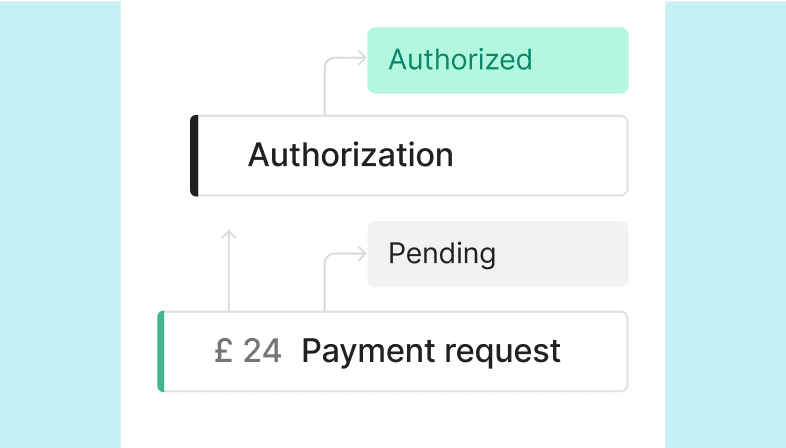

5. Explore your payments

Get full visibility into the journey of each payment, so you can easily see what’s going on.

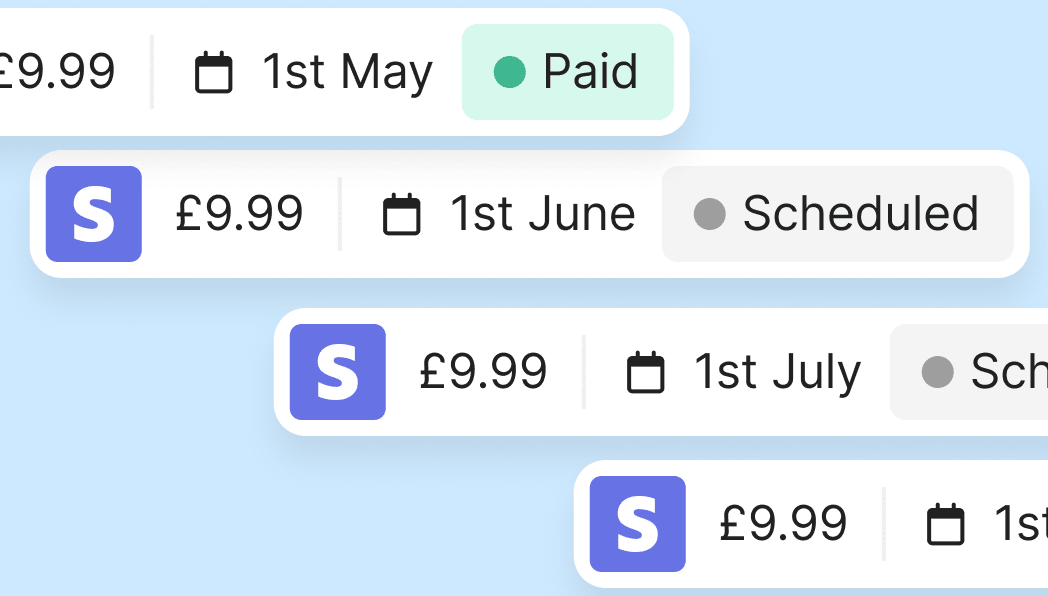

6. Recurring payments

Manage your recurring payments seamlessly with our Payments API.