- a test card that will decline or fail with your primary processor under one of the conditions outlined above

- a fallback processor that will authorize the payment based on the test card used to decline or fail with the first processor

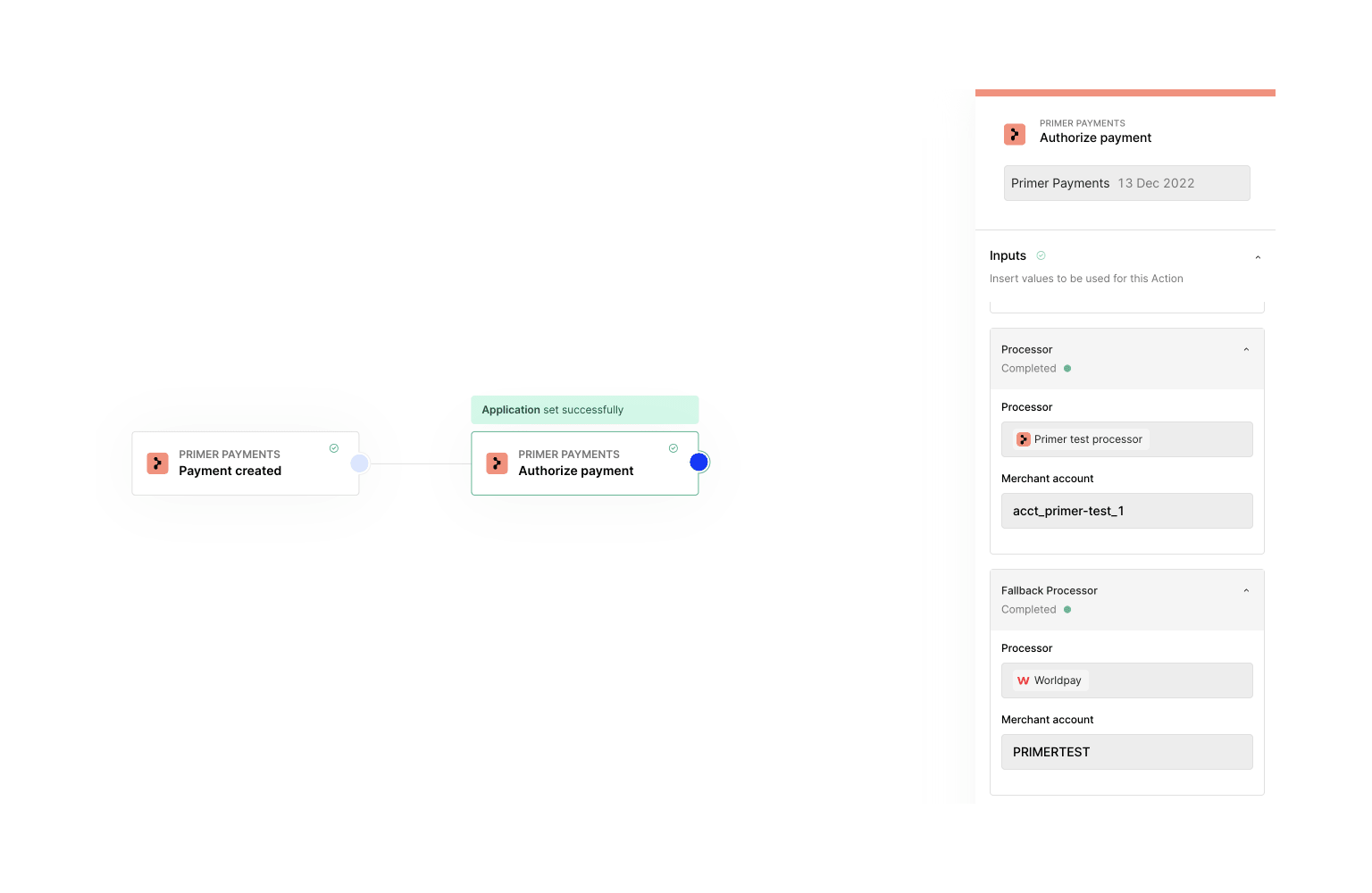

Primer test processor

In sandbox, set the Primer test processor as the primary processor and an alternative processor as the fallback processor, such as Braintree, Stripe or Worldpay. Failed and declined authorization Use the following test cards to simulate a failed or declined authorization. Use any 3-digit CVV and future expiry date to trigger the test scenario.| Scenario | Card Network | Card Number |

|---|---|---|

| Generic decline | Visa | 4000 0000 0000 0002 |

| Generic decline | Mastercard | 5100 0000 0000 0008 |

| Generic fail | Visa | 4000 0000 0000 0010 |

| Generic fail | Mastercard | 5100 0000 0000 0016 |

Other sandbox processors

It’s possible to test fallbacks without using the Primer test processor. You will need to review the testing guides for your processors and ensure:- you can decline or fail a payment with your primary processor for the conditions outlined above

- the test card or test scenario can lead to a successful authorization request with your fallback processor

Braintree

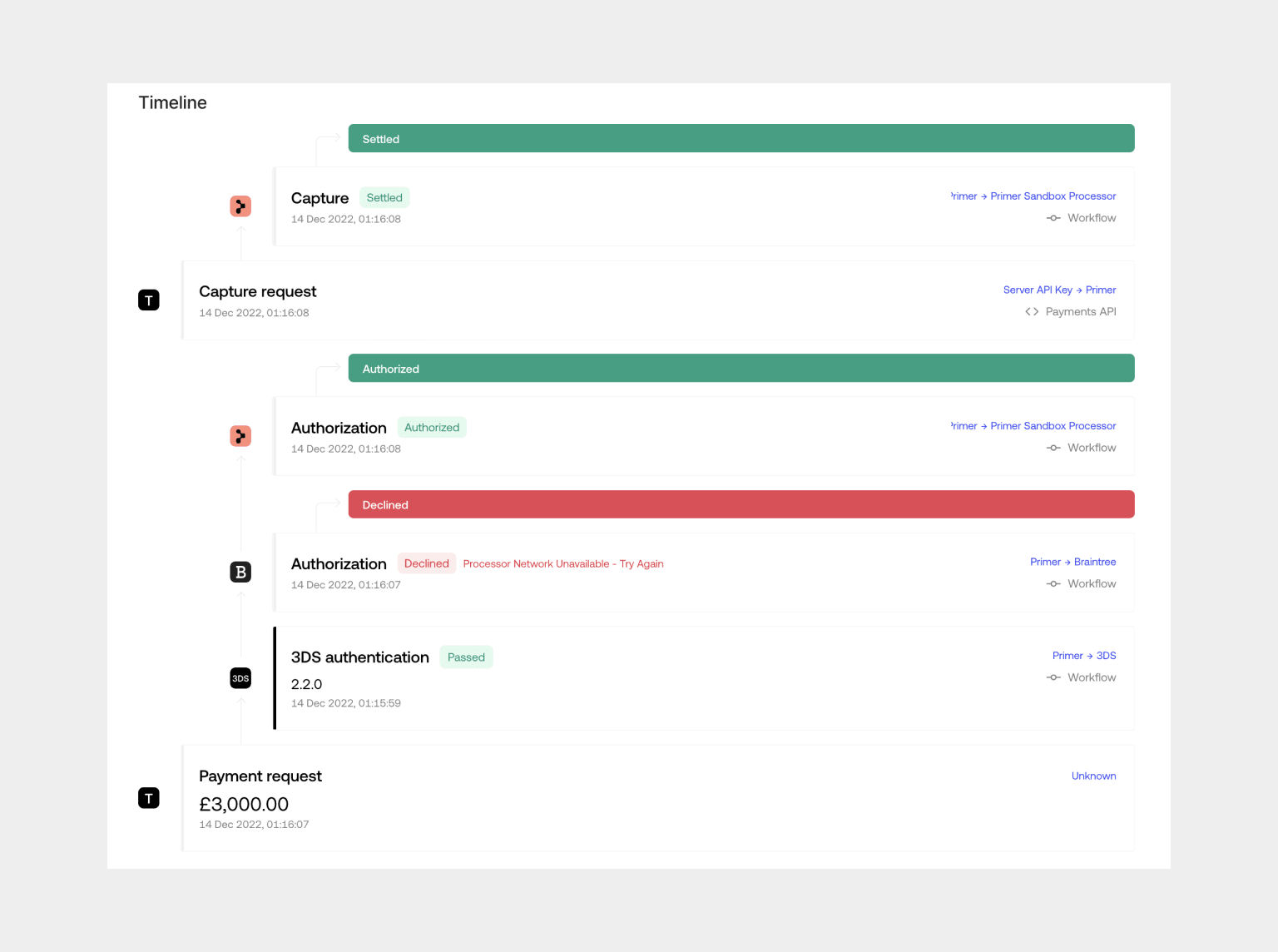

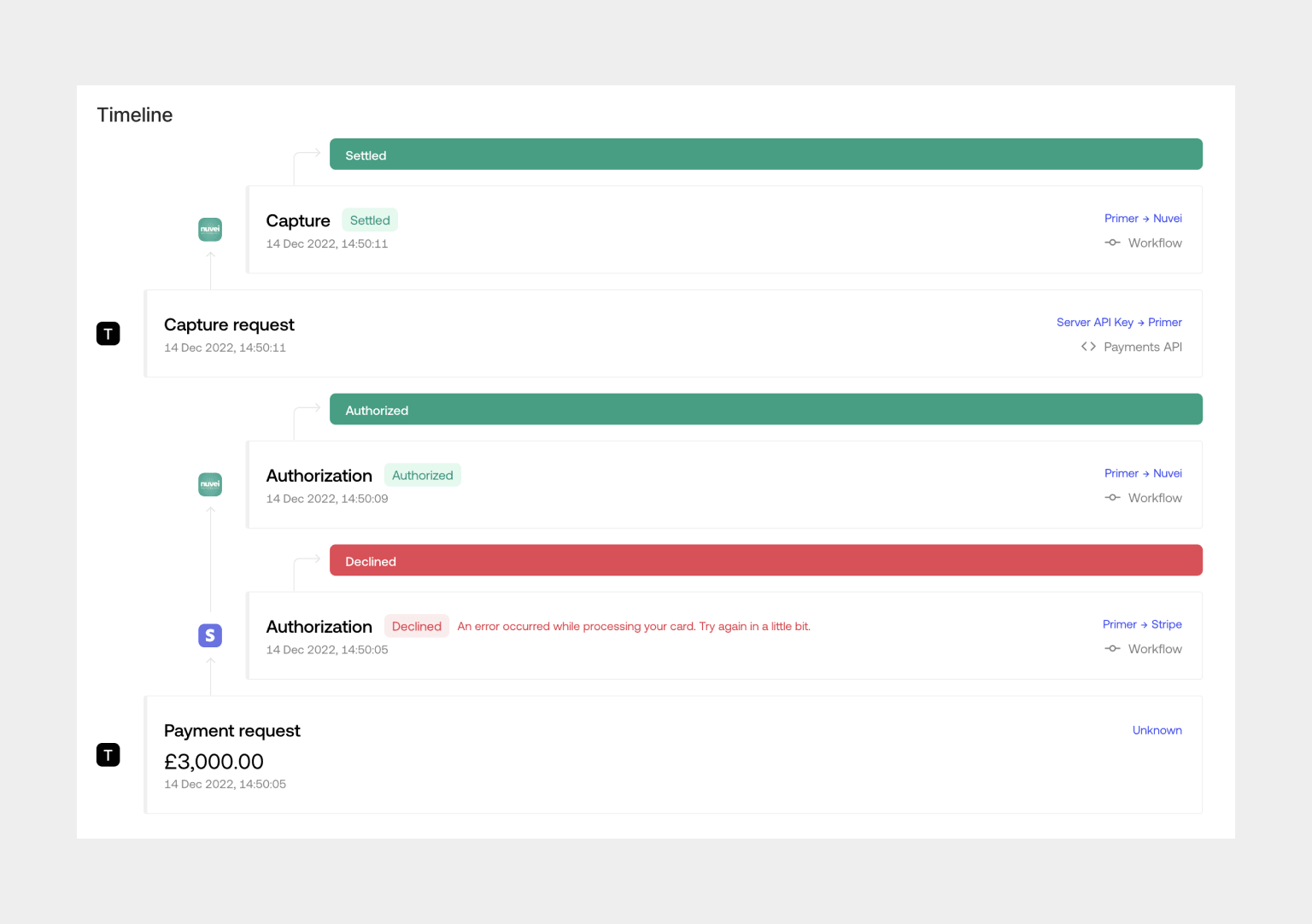

Braintree enable authorization responses to be determined by the authorization amount. You can test fallbacks using Braintree as your primary processor.If the amount is set to 3000.00-3000.99, then this will trigger a fallback.

You can test fallbacks with 3DS using Braintree as your primary processor as the authorization response is determined by the amount, not the test card. You will also need a fallback processor, such as the Primer test processor, that will accept Primer’s 3DS test card which is required to trigger 3DS in sandbox.

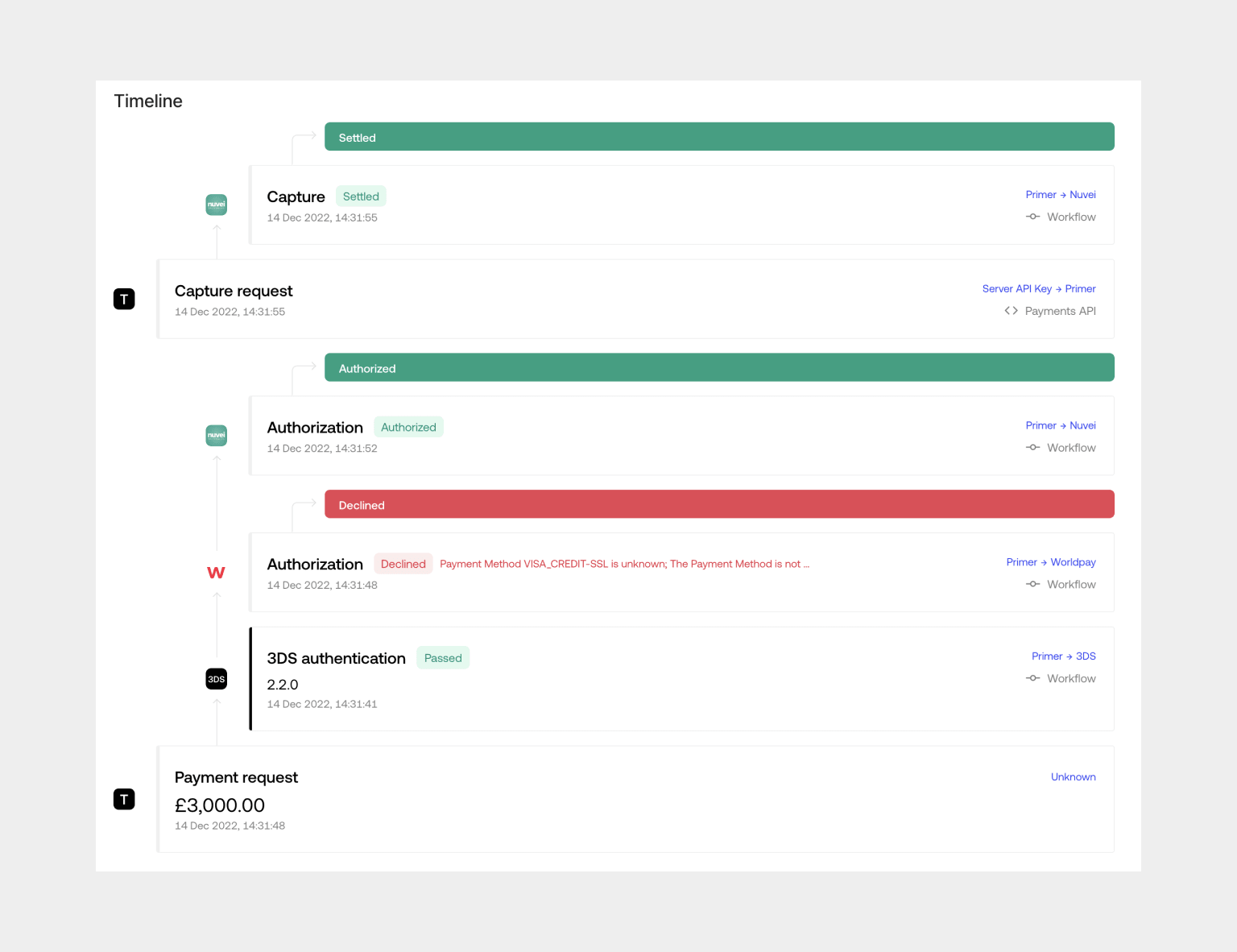

Worldpay

Worldpay enable authorization responses to be determined by the cardholder name. You can test fallbacks using Worldpay as your primary processor.If the cardholder name is set to “ERROR”, then this will trigger a fallback.

You can test fallbacks with 3DS using Worldpay as your primary processor as the authorization response is determined by the cardholder name, not the test card. You will also need a fallback processor, such as the Primer test processor, that will accept Primer’s 3DS test card which is required to trigger 3DS in sandbox.

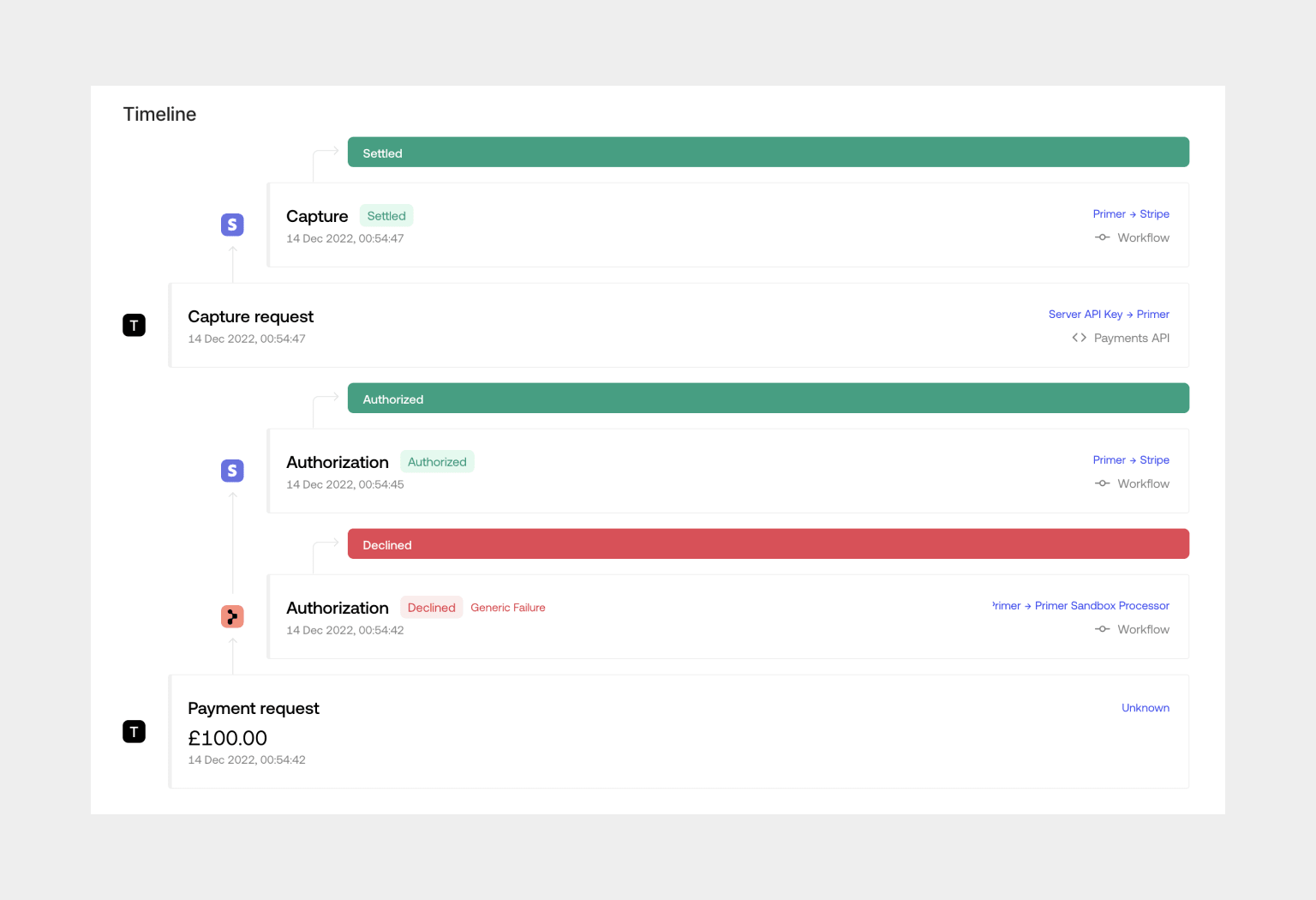

Stripe

Stripe enable authorization responses to be determined by the card number. You can test fallbacks using Stripe as your primary processor.If the card number is set to

4000000000000119, then this will trigger a fallback.4000000000000119 and ensure this card will result in an authorized payment with your fallback processor.

The authorization will decline and trigger a fallback. The fallback request should then be sent and be authorized.

You can’t test fallbacks with 3DS using Stripe as your primary processor as the authorization response is determined by the card number. This clashes with Primer’s 3DS test card which is required to trigger 3DS in sandbox.