Payments

Consolidate your payment stack and create great payment experiences.

Process payments

Primer brings together all your preferred payment services in a single, easy-to-implement integration.

Build the way you want

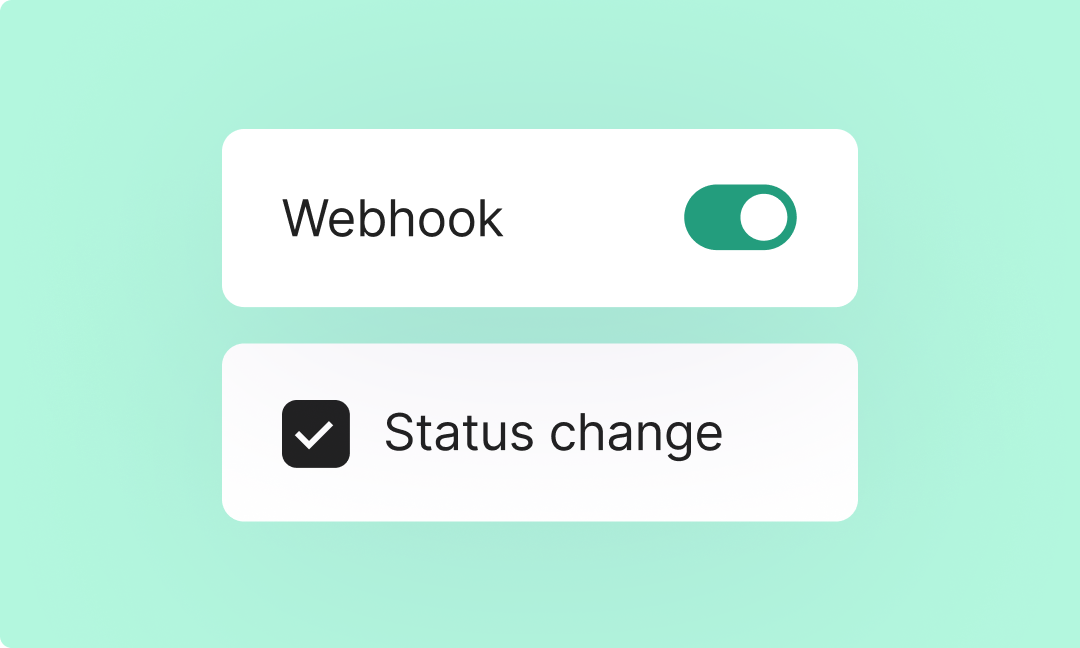

Receive payment notifications

Primer Payment supports server notifications via webhooks to give you visibility on the status of your payments.