Everything you need

to build with Primer

Learn how to connect, build, and scale with Primer. Our docs offer clear guides and technical references to help you get more from our unified payments infrastructure.

Get Started

Your first stop - everything you need to start building with Primer.

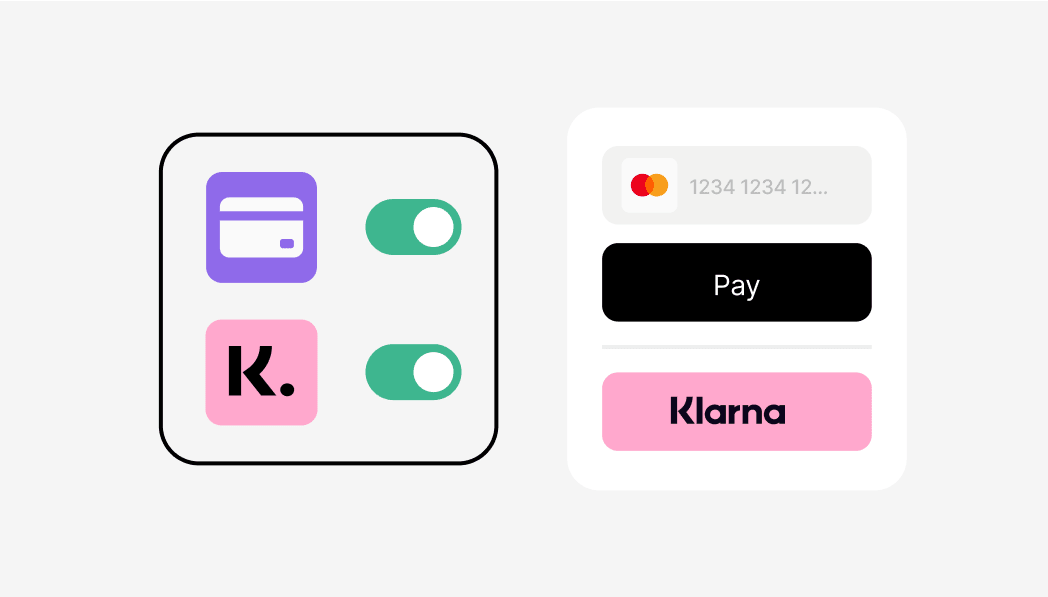

Connections

Plug into your favorite tools and start building powerful flows.

Changelogs

See what’s new, what’s better, and what’s coming next.

API Reference

All the endpoints and payloads you need to build with Primer.

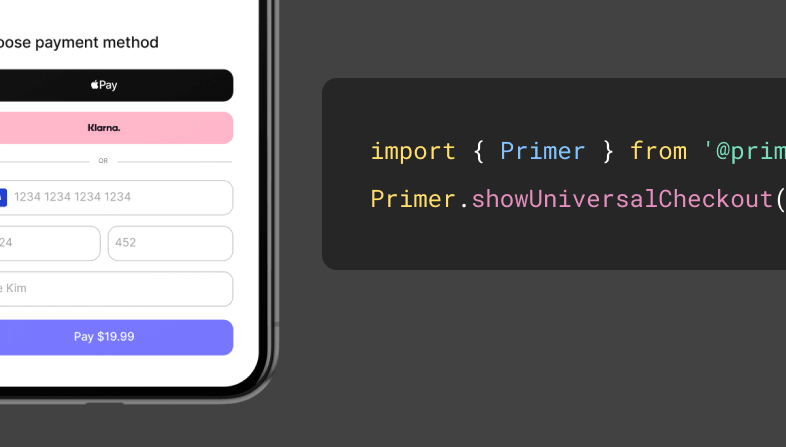

SDK Reference

Add our Checkout SDKs and bring your integration to life with just a few lines of code.

Knowledge base

Got questions? Find answers, practical tips, and how-tos.

Get Started

Your first stop - everything you need to start building with Primer.

Connections

Plug into your favorite tools and start building powerful flows.

Changelogs

See what’s new, what’s better, and what’s coming next.

API Reference

All the endpoints and payloads you need to build with Primer.

SDK Reference

Add our Checkout SDKs and bring your integration to life with just a few lines of code.

Knowledge base

Got questions? Find answers, practical tips, and how-tos.